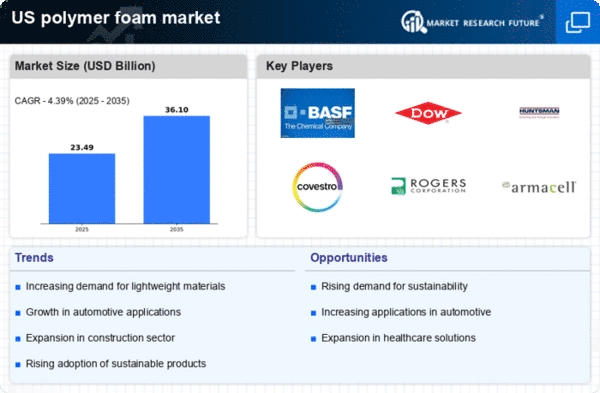

The polymer foam market exhibits a dynamic competitive landscape characterized by innovation and strategic partnerships. Key players such as BASF SE (DE), Dow Inc. (US), and Huntsman Corporation (US) are actively shaping the market through their distinct operational focuses. BASF SE (DE) emphasizes sustainability and product innovation, aiming to enhance its portfolio with eco-friendly solutions. Dow Inc. (US) is concentrating on digital transformation and advanced manufacturing techniques, which are likely to improve efficiency and reduce costs. Huntsman Corporation (US) appears to be pursuing strategic acquisitions to bolster its market position, thereby enhancing its product offerings and expanding its customer base. Collectively, these strategies indicate a trend towards a more integrated and sustainable approach within the competitive environment.The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing. The market structure is moderately fragmented, with several players vying for market share. However, the influence of major companies is substantial, as they leverage their resources to drive innovation and establish competitive advantages. This competitive structure suggests that while there is room for smaller players, the dominance of key players is likely to shape market trends and consumer preferences.

In October Dow Inc. (US) announced a partnership with a leading technology firm to develop AI-driven solutions for optimizing foam production processes. This strategic move is expected to enhance operational efficiency and reduce waste, aligning with the growing emphasis on sustainability in manufacturing. The integration of AI technologies could potentially revolutionize production methodologies, allowing for more precise control over material properties and reducing costs.

In September Huntsman Corporation (US) completed the acquisition of a specialty foam manufacturer, which is anticipated to expand its product range and strengthen its market presence. This acquisition not only diversifies Huntsman's offerings but also positions the company to better serve emerging markets that demand innovative foam solutions. The strategic importance of this move lies in its potential to enhance customer engagement and drive revenue growth through a broader product portfolio.

In August BASF SE (DE) launched a new line of bio-based polymer foams, reflecting its commitment to sustainability and innovation. This product line is designed to meet the increasing demand for environmentally friendly materials in various applications, including automotive and construction. The introduction of bio-based options is likely to attract environmentally conscious consumers and could set a new standard in the industry, pushing competitors to follow suit.

As of November current trends in the polymer foam market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing supply chain reliability. The competitive differentiation is expected to evolve from traditional price-based competition towards a focus on technological advancements and sustainable practices. This shift indicates that companies that prioritize innovation and adaptability will likely emerge as leaders in the market.