Influence of Dietary Trends

The plant based-protein market is significantly influenced by emerging dietary trends, such as veganism and flexitarianism. These trends are reshaping consumer preferences, leading to a greater acceptance of plant-based diets. Data indicates that the number of vegans in the US has increased by over 300% in the past decade, suggesting a substantial shift in dietary habits. This growing demographic is driving the plant based-protein market to innovate and diversify its product offerings, catering to a wider range of dietary needs and preferences. As more consumers adopt these dietary patterns, the demand for plant based-protein products is expected to continue its upward trajectory.

Support from Food Industry Initiatives

The plant based-protein market is receiving considerable support from various food industry initiatives aimed at promoting sustainable eating practices. Organizations and companies are increasingly collaborating to develop and market plant-based products that align with consumer demand for sustainability. For instance, several major food brands have committed to reducing their carbon footprints by incorporating more plant-based ingredients into their products. This trend is likely to bolster the plant based-protein market, as it not only enhances product visibility but also encourages consumers to make more environmentally friendly choices. The financial backing and marketing efforts from these initiatives are expected to drive growth in the sector.

Increasing Demand for Meat Alternatives

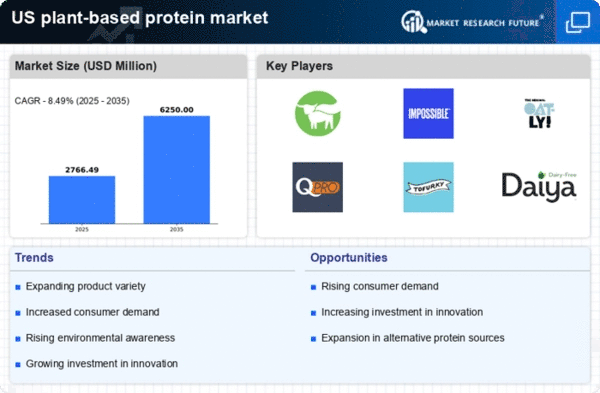

The plant based-protein market is experiencing a notable surge in demand for meat alternatives, driven by a growing consumer preference for healthier and more sustainable food options. Recent data indicates that the market for meat substitutes is projected to reach approximately $4.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 20%. This shift is largely influenced by consumers seeking to reduce their meat consumption for health reasons, as well as a desire to minimize their environmental impact. The plant based-protein market is thus adapting to this trend by expanding its offerings of innovative meat alternatives, which are increasingly available in supermarkets and restaurants across the country.

Rising Awareness of Nutritional Benefits

The plant based-protein market is benefiting from a heightened awareness of the nutritional advantages associated with plant-based diets. Research suggests that plant proteins can offer comparable, if not superior, health benefits compared to animal proteins, including lower cholesterol levels and reduced risk of chronic diseases. As consumers become more informed about the health implications of their dietary choices, the demand for plant based-protein products is likely to increase. In fact, a survey revealed that nearly 60% of consumers in the US are actively seeking to incorporate more plant-based proteins into their diets. This trend is prompting manufacturers within the plant based-protein market to enhance their product lines with nutrient-rich options that appeal to health-conscious consumers.

Regulatory Support for Plant-Based Products

The plant based-protein market is also benefiting from regulatory support that encourages the development and consumption of plant-based products. Recent policies aimed at promoting healthier eating habits and reducing environmental impact have led to increased funding for plant-based food innovation. Government initiatives are focusing on providing grants and subsidies to companies that produce plant-based proteins, thereby fostering growth within the plant based-protein market. This regulatory environment is likely to enhance the competitiveness of plant-based products, making them more accessible and appealing to a broader audience.