Rising Demand for Generic Drugs

The increasing acceptance of generic drugs in the pharmaceutical sector is a notable driver for the pharmaceutical hdpe-bottles market. As healthcare costs continue to rise, healthcare providers and patients are gravitating towards more affordable alternatives. In 2025, generic drugs account for approximately 90% of all prescriptions filled in the US, which subsequently boosts the demand for packaging solutions like HDPE bottles. These bottles are favored for their durability and cost-effectiveness, making them ideal for generic drug manufacturers. The pharmaceutical hdpe-bottles market is likely to experience growth as more companies seek reliable packaging that meets regulatory standards while keeping costs low.

Focus on Patient-Centric Packaging

The pharmaceutical industry is increasingly emphasizing patient-centric packaging, which serves as a key driver for the pharmaceutical hdpe-bottles market. Packaging that enhances usability and accessibility is becoming essential, particularly for elderly patients and those with disabilities. In 2025, the market sees a shift towards designs that facilitate easier handling and dosing, which may include features like child-resistant caps and ergonomic shapes. This focus on patient experience is likely to propel the demand for innovative HDPE bottle designs that cater to these needs, thereby influencing the overall growth of the pharmaceutical hdpe-bottles market.

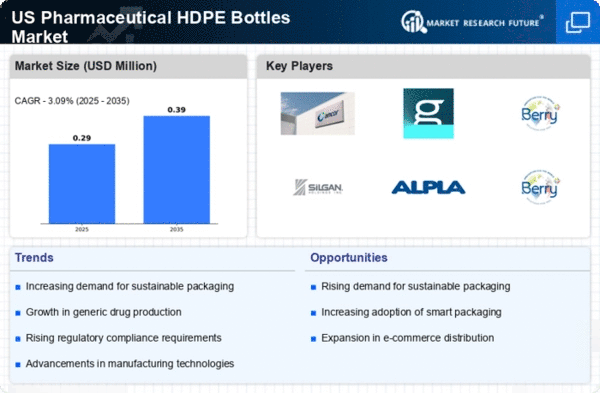

Sustainability Trends in Packaging

Sustainability is emerging as a pivotal driver in the pharmaceutical hdpe-bottles market. As environmental concerns gain prominence, pharmaceutical companies are increasingly seeking eco-friendly packaging solutions. In 2025, a significant % of consumers express a preference for products packaged in recyclable materials, prompting manufacturers to explore sustainable options. HDPE bottles, known for their recyclability, align well with these sustainability initiatives. This shift towards greener packaging solutions is likely to influence purchasing decisions, thereby driving the demand for pharmaceutical hdpe-bottles that meet both regulatory requirements and consumer expectations for sustainability.

Growth in E-commerce Pharmaceutical Sales

The surge in e-commerce for pharmaceutical products is reshaping the landscape of the pharmaceutical hdpe-bottles market. As online pharmacies gain traction, the need for secure and efficient packaging becomes increasingly critical. In 2025, e-commerce sales in the pharmaceutical sector are projected to reach $100 billion in the US, necessitating robust packaging solutions that can withstand shipping and handling. HDPE bottles are particularly suited for this purpose due to their lightweight and shatter-resistant properties. This trend indicates a potential increase in demand for pharmaceutical hdpe-bottles as online sales continue to grow, prompting manufacturers to adapt their packaging strategies accordingly.

Regulatory Compliance and Safety Standards

Stringent regulatory requirements imposed by agencies such as the FDA significantly influence the pharmaceutical hdpe-bottles market. Compliance with safety standards is paramount for pharmaceutical companies, as any lapses can lead to severe penalties and product recalls. In 2025, the FDA continues to enforce rigorous guidelines regarding packaging materials, which necessitates the use of high-quality HDPE bottles that ensure product integrity and safety. This regulatory landscape compels manufacturers to invest in reliable packaging solutions, thereby driving the demand for pharmaceutical hdpe-bottles. The market is expected to expand as companies prioritize compliance and safety in their packaging choices.