Rising Cybersecurity Threats

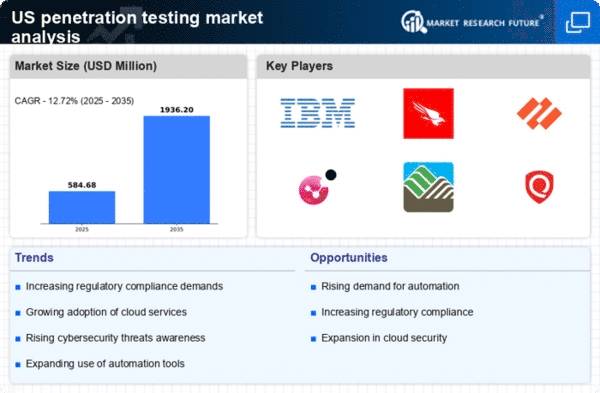

The penetration testing market is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations are recognizing the necessity of proactive security measures to safeguard sensitive data. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, prompting a surge in demand for penetration testing services. This market driver highlights the urgency for companies to identify vulnerabilities before they can be exploited by malicious actors. As a result, is projected to expand significantly, with a compound annual growth rate (CAGR) of approximately 12% over the next five years. The need for comprehensive security assessments is becoming a priority for businesses across various sectors, thereby driving the penetration testing market forward.

Growing Awareness of Data Privacy

The heightened awareness of data privacy among consumers and businesses is a key driver for the penetration testing market. With regulations such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) influencing corporate policies, organizations are compelled to ensure compliance with stringent data protection standards. In 2025, it is anticipated that companies will invest over $20 billion in compliance-related services, including penetration testing. This trend underscores the necessity for businesses to identify and mitigate vulnerabilities that could lead to data breaches. As a result, the penetration testing market is likely to experience increased demand as organizations seek to protect sensitive information and maintain consumer trust.

Increased Investment in IT Security

Organizations are allocating larger budgets towards IT security, which is a crucial driver for the penetration testing market. In 2025, IT security spending in the US is expected to reach $150 billion, reflecting a growing recognition of the importance of cybersecurity. This investment is not only aimed at compliance but also at enhancing overall security posture. Companies are increasingly seeking penetration testing services to evaluate their defenses against potential breaches. The penetration testing market is likely to benefit from this trend, as businesses prioritize risk management and vulnerability assessments. Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning into penetration testing services is expected to enhance their effectiveness, further propelling market growth.

Emergence of Remote Work Security Challenges

The shift towards remote work has introduced new security challenges, thereby impacting the penetration testing market. As more employees work from home, organizations face increased risks associated with unsecured networks and devices. In 2025, it is estimated that 30% of the US workforce will continue to work remotely, necessitating enhanced security measures. This trend is prompting businesses to invest in penetration testing services to assess their remote work security posture. The penetration testing market is expected to grow as companies seek to identify vulnerabilities in their remote access solutions and ensure that their cybersecurity measures are effective in a distributed work environment. This evolving landscape presents both challenges and opportunities for penetration testing service providers.

Demand for Skilled Cybersecurity Professionals

The penetration testing market is significantly influenced by the demand for skilled cybersecurity professionals. As organizations strive to bolster their security frameworks, the need for qualified penetration testers is becoming more pronounced. In 2025, the cybersecurity workforce gap in the US is projected to exceed 3 million positions, indicating a critical shortage of talent. This shortage is driving companies to invest in penetration testing services to ensure their security measures are robust. is likely to see an increase in service offerings as firms seek to fill this gap through outsourcing. Consequently, the demand for specialized penetration testing services is expected to rise, reflecting the ongoing challenges in recruiting and retaining skilled cybersecurity personnel.