Emergence of Mobile Applications

The proliferation of mobile applications is reshaping the passenger information-system market. As smartphone usage continues to rise, passengers increasingly rely on mobile apps for accessing travel information. In the US, it is estimated that over 60% of travelers utilize mobile applications to receive updates on their journeys. This trend has prompted transportation providers to develop user-friendly applications that integrate seamlessly with existing passenger information systems. By offering features such as push notifications, interactive maps, and personalized travel alerts, these applications enhance the overall passenger experience. Thus, the passenger information-system market is likely to witness significant growth as mobile technology becomes a central component of information dissemination.

Rising Focus on Safety and Security

Safety and security concerns are becoming increasingly paramount in the passenger information-system market. With the rise in security threats and the need for enhanced safety protocols, transportation providers are compelled to adopt systems that not only inform passengers but also ensure their safety. The US has seen a notable increase in funding for security-related technologies, with estimates suggesting that investments in safety systems could reach $1 billion by 2026. This trend indicates a shift towards integrating safety features within passenger information systems, such as emergency alerts and real-time monitoring. Consequently, the passenger information-system market is likely to expand as operators seek to implement solutions that address these critical safety concerns.

Growing Demand for Real-Time Information

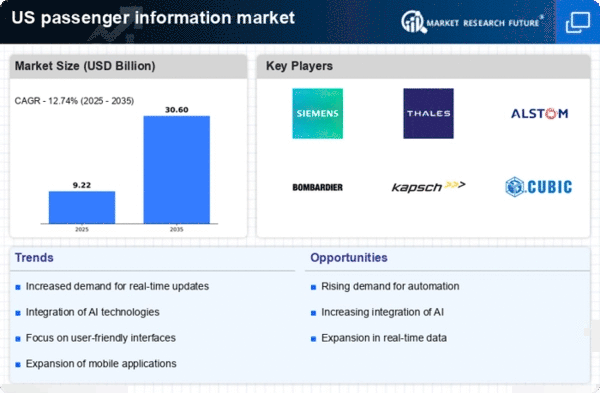

The increasing expectation for real-time information among passengers is a primary driver in the passenger information-system market. As travelers seek timely updates regarding schedules, delays, and other critical information, systems that can deliver this data instantaneously are becoming essential. In the US, the demand for real-time updates has surged, with studies indicating that over 70% of passengers prefer systems that provide live information. This trend compels transportation providers to invest in advanced passenger information systems that can integrate with various data sources, ensuring that users receive accurate and up-to-date information. Consequently, the passenger information-system market is likely to experience substantial growth as operators prioritize the implementation of technologies that enhance communication and information dissemination.

Regulatory Support for Enhanced Information Systems

Regulatory frameworks are playing a crucial role in shaping the passenger information-system market. In the US, government agencies are increasingly recognizing the importance of effective passenger information systems in improving transportation efficiency and user satisfaction. Recent regulations have mandated that public transportation agencies implement systems that provide accurate and timely information to passengers. This regulatory support is likely to drive investments in advanced technologies and systems that meet compliance requirements. As agencies strive to enhance service delivery, the passenger information-system market is expected to benefit from increased funding and resources allocated towards developing robust information systems.

Increased Investment in Smart Transportation Infrastructure

The push towards smart transportation infrastructure is significantly influencing the passenger information-system market. With the US government allocating billions of dollars towards modernizing transportation networks, there is a clear focus on integrating advanced technologies into existing systems. This investment is expected to enhance the efficiency and reliability of passenger information systems. For instance, the Federal Transit Administration has reported that funding for smart transit initiatives has increased by approximately 25% in recent years. Such financial backing encourages the development of innovative solutions that improve passenger experience and operational efficiency. As a result, the passenger information-system market is poised for growth, driven by the need for smarter, more connected transportation solutions.