Growth of DIY Culture

The rise of the DIY culture significantly impacts the outdoor power-equipment market, as more individuals take on home improvement and landscaping projects. This trend is fueled by the availability of online resources, tutorials, and community support, empowering consumers to invest in their outdoor spaces. In 2025, the DIY home improvement market is projected to exceed $400 billion, indicating a robust interest in personalizing outdoor environments. Consequently, the demand for user-friendly outdoor power tools is likely to increase, as consumers seek equipment that is both effective and easy to operate. Retailers are responding by expanding their offerings of outdoor power equipment tailored for DIY enthusiasts, further driving growth in the market. This cultural shift not only enhances the appeal of outdoor power tools but also fosters a sense of accomplishment among consumers, thereby solidifying their commitment to outdoor projects.

Increased Focus on Sustainability

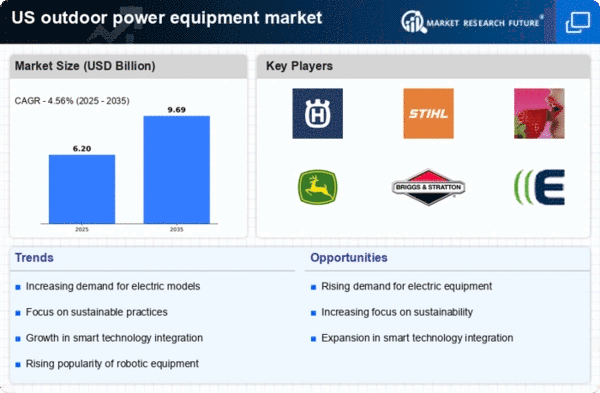

the market is increasingly influenced by a growing emphasis on sustainability and environmental responsibility.. Consumers are becoming more aware of the ecological impact of their choices, leading to a preference for equipment that minimizes carbon footprints. In 2025, it is estimated that sales of electric and battery-operated outdoor power tools will account for over 30% of the total market share, reflecting a significant shift towards greener alternatives. This trend is further supported by government initiatives promoting the use of low-emission equipment, which encourages manufacturers to innovate and produce more sustainable options. As a result, the outdoor power-equipment market is likely to witness a transformation, with an increasing number of products designed to meet stringent environmental standards, thereby appealing to environmentally conscious consumers.

Urbanization and Population Growth

Urbanization and population growth are pivotal factors influencing the outdoor power-equipment market. As more people move to urban areas, the demand for residential and commercial landscaping services rises, necessitating the use of efficient outdoor power tools. In 2025, urban areas are expected to house over 80% of the US population, leading to increased competition among landscaping service providers. This competitive landscape drives the need for advanced equipment that can deliver superior results in less time. Additionally, the trend towards smaller living spaces, such as townhouses and apartments, often includes the incorporation of outdoor areas that require maintenance. Consequently, the market is likely to benefit from the growing need for compact and versatile tools that cater to urban dwellers., thereby enhancing market opportunities.

Rising Demand for Landscaping Services

The outdoor power-equipment market experiences a notable surge in demand due to the increasing popularity of landscaping services among homeowners and businesses. As urban areas expand, the need for aesthetically pleasing outdoor spaces becomes paramount. In 2025, the landscaping services industry in the US is projected to reach approximately $100 billion, indicating a robust growth trajectory. This growth directly influences the outdoor power-equipment market, as professionals require advanced tools and machinery to meet client expectations. Furthermore, the trend towards outdoor living spaces, including gardens and patios, necessitates the use of specialized equipment, thereby driving sales in the outdoor power-equipment market. The emphasis on maintaining well-manicured lawns and gardens further propels the demand for efficient and reliable power tools, creating a favorable environment for market expansion.

Technological Advancements in Equipment

Technological innovations play a crucial role in shaping the outdoor power-equipment market. The introduction of advanced features such as battery-powered tools, automated systems, and improved engine efficiency enhances user experience and operational effectiveness. In 2025, the market for battery-powered outdoor equipment is expected to grow by over 20%, reflecting a shift towards more sustainable and eco-friendly options. These advancements not only improve performance but also reduce environmental impact, aligning with consumer preferences for greener solutions. As manufacturers invest in research and development, the outdoor power-equipment market benefits from a continuous influx of innovative products that cater to both professional landscapers and DIY enthusiasts. The integration of smart technology, such as IoT-enabled devices, further enhances the functionality of outdoor power tools, making them more appealing to a tech-savvy consumer base.