Regulatory Support for Organic Products

Regulatory frameworks supporting organic products are becoming increasingly robust, which is beneficial for the organic natural-feminine-care market. Government initiatives aimed at promoting organic farming and product certification are likely to enhance consumer trust in organic labels. This regulatory support not only facilitates market entry for new brands but also encourages existing companies to adopt organic practices. As consumers become more discerning about product authenticity, the presence of regulatory backing can significantly influence purchasing decisions. The organic natural-feminine-care market stands to gain from these developments, as they may lead to increased market penetration and consumer confidence in organic offerings.

Rise of Sustainable Packaging Solutions

Sustainability has become a pivotal concern within the organic natural-feminine-care market, particularly regarding packaging. As consumers increasingly prioritize eco-friendly products, brands are compelled to adopt sustainable packaging solutions. This shift is evidenced by a growing number of companies transitioning to biodegradable, recyclable, or reusable materials. Market Research Future suggests that approximately 60% of consumers are willing to pay more for products that utilize sustainable packaging. This trend not only reflects a commitment to environmental responsibility but also enhances brand loyalty among eco-conscious consumers. As the organic natural-feminine-care market evolves, the integration of sustainable packaging is likely to play a crucial role in attracting and retaining customers who value both product efficacy and environmental impact.

Increasing Demand for Natural Ingredients

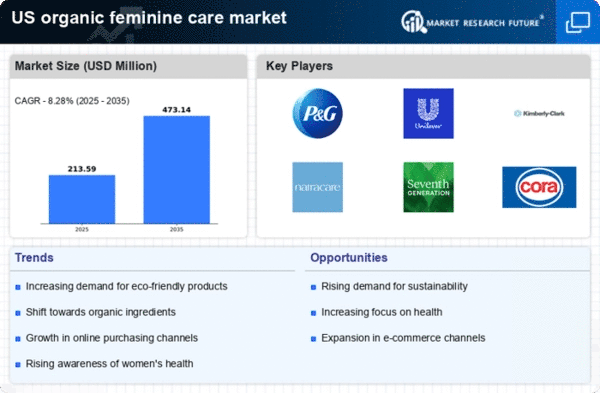

The organic natural-feminine-care market experiences a notable surge in demand for products containing natural ingredients. Consumers are increasingly aware of the potential health risks associated with synthetic chemicals, leading to a preference for organic alternatives. This shift is reflected in market data, indicating that the organic segment of the feminine care market is projected to grow at a CAGR of approximately 8% over the next five years. As awareness of the benefits of natural ingredients continues to rise, brands are responding by reformulating products to meet consumer expectations. This trend not only enhances product appeal but also aligns with the growing consumer desire for sustainability and health-conscious choices. Consequently, the organic natural-feminine-care market is likely to see a significant expansion as more consumers opt for products that prioritize natural ingredients.

Influence of Social Media and Influencers

The organic natural-feminine-care market is significantly influenced by social media platforms and the rise of influencers. These digital channels serve as vital platforms for educating consumers about the benefits of organic products. Influencers often share personal experiences and product recommendations, which can sway purchasing decisions. Data indicates that nearly 70% of consumers trust recommendations from influencers more than traditional advertising. This trend has led brands to collaborate with influencers to enhance visibility and credibility. As social media continues to shape consumer perceptions, the organic natural-feminine-care market is likely to benefit from increased engagement and awareness, ultimately driving sales and market growth.

Growing Awareness of Women's Health Issues

There is a marked increase in awareness surrounding women's health issues, which is positively impacting the organic natural-feminine-care market. As discussions about menstrual health, reproductive rights, and overall wellness gain traction, consumers are seeking products that align with their health values. This heightened awareness has led to a demand for organic products that are perceived as safer and more effective. Market data suggests that the organic segment is expected to capture a larger share of the feminine care market, with projections indicating a growth rate of around 7% annually. This trend underscores the importance of addressing women's health concerns through organic solutions, thereby fostering a more informed consumer base.