Growing Focus on Waste Reduction

The optical sorter market is witnessing a growing focus on waste reduction and resource recovery, particularly in the recycling sector. As environmental concerns gain prominence, companies are increasingly adopting optical sorting technologies to improve the efficiency of material recovery processes. The market is projected to expand as municipalities and private firms invest in advanced sorting systems to enhance recycling rates and reduce landfill waste. This trend aligns with broader sustainability goals, as businesses aim to minimize their environmental footprint. The emphasis on waste reduction is likely to propel the optical sorter market, as organizations seek innovative solutions to optimize resource utilization.

Rising Demand for Quality Control

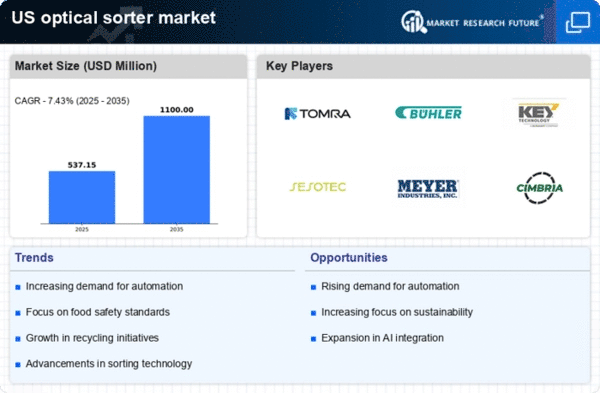

The optical sorter market is experiencing a notable increase in demand for quality control across various industries, particularly in food processing and recycling. As consumers become more discerning about product quality, manufacturers are compelled to adopt advanced sorting technologies to ensure compliance with safety and quality standards. This trend is reflected in the market data, which indicates that the optical sorter market is projected to grow at a CAGR of approximately 8% from 2025 to 2030. Companies are investing in optical sorting systems to enhance product purity and reduce contamination, thereby improving overall operational efficiency. The emphasis on quality assurance is likely to drive the adoption of optical sorters, as businesses seek to maintain competitive advantages in a crowded marketplace.

Increased Investment in Automation

The optical sorter market is benefiting from a surge in investments aimed at automating production processes. As industries strive to enhance productivity and reduce labor costs, the integration of optical sorting technology becomes increasingly attractive. The market is projected to reach a valuation of $1.5 billion by 2027, driven by the need for efficient sorting solutions that minimize human intervention. Automation not only streamlines operations but also improves accuracy in sorting, which is crucial for sectors such as agriculture and recycling. The trend towards automation is likely to propel the optical sorter market forward, as companies recognize the potential for increased throughput and reduced operational risks.

Regulatory Compliance and Safety Standards

The optical sorter market is significantly influenced by stringent regulatory compliance and safety standards imposed by government agencies. Industries such as food and beverage, pharmaceuticals, and waste management are required to adhere to rigorous quality and safety regulations. This necessitates the adoption of advanced sorting technologies to ensure that products meet the required specifications. The market is expected to grow as companies invest in optical sorting systems to comply with these regulations, thereby avoiding potential fines and enhancing their reputations. The increasing focus on safety and compliance is likely to drive the demand for optical sorters, as businesses seek to mitigate risks associated with non-compliance.

Technological Innovations in Sorting Solutions

The optical sorter market is characterized by rapid technological innovations that enhance sorting capabilities and efficiency. Advancements in machine learning, artificial intelligence, and imaging technologies are enabling optical sorters to achieve higher accuracy and speed in sorting processes. The market is expected to benefit from these innovations, as companies seek to leverage cutting-edge technologies to improve operational performance. The introduction of smart sorting systems that can adapt to varying material characteristics is likely to drive growth in the optical sorter market. As industries continue to evolve, the demand for sophisticated sorting solutions will likely increase, further propelling the market forward.