Increased Focus on Operational Efficiency

In the current business landscape, the operational analytics market is significantly influenced by the heightened focus on operational efficiency. Organizations are striving to streamline processes, minimize waste, and optimize resource allocation. This trend is evident in various sectors, including manufacturing, retail, and logistics, where companies are utilizing analytics to identify bottlenecks and enhance productivity. The operational analytics market is projected to reach a valuation of $10 billion by 2026, reflecting the growing investment in tools that facilitate process improvement. As businesses aim to achieve higher efficiency levels, the demand for operational analytics solutions is expected to rise, further propelling market growth.

Growing Importance of Regulatory Compliance

The operational analytics market is also being driven by the growing importance of regulatory compliance across various industries. Organizations are required to adhere to stringent regulations regarding data management, privacy, and reporting. As a result, there is an increasing demand for analytics solutions that can help businesses ensure compliance while optimizing their operations. The operational analytics market is expected to benefit from this trend, as companies seek tools that provide insights into compliance-related metrics and facilitate reporting processes. This focus on regulatory compliance is likely to contribute to the market's growth, as organizations invest in analytics capabilities to mitigate risks and avoid potential penalties.

Emergence of Advanced Analytics Technologies

The operational analytics market is being shaped by the emergence of advanced analytics technologies, which are transforming how organizations analyze and interpret data. Technologies such as predictive analytics, prescriptive analytics, and big data analytics are gaining traction, enabling businesses to uncover hidden patterns and make informed decisions. The integration of these technologies is anticipated to enhance the capabilities of operational analytics tools, leading to more accurate forecasts and improved operational strategies. As organizations increasingly adopt these advanced technologies, the operational analytics market is likely to expand, with a projected growth rate of 20% annually over the next five years. This trend indicates a shift towards more sophisticated analytical approaches in the industry.

Rising Demand for Data-Driven Decision Making

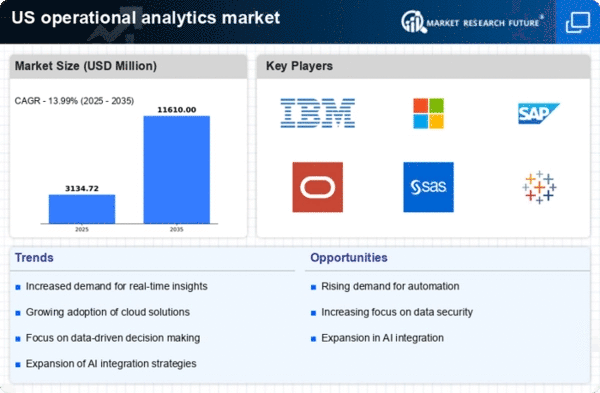

The operational analytics market is experiencing a notable surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies are leveraging analytics to enhance operational efficiency, reduce costs, and improve customer satisfaction. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% from 2025 to 2030. This growth is fueled by the need for businesses to adapt to rapidly changing market conditions and consumer preferences. As a result, organizations are investing in advanced analytics tools to gain insights from vast amounts of data, thereby driving the operational analytics market forward. The emphasis on data-driven strategies is likely to continue, as firms seek to maintain a competitive edge in their respective industries.

Shift Towards Predictive Maintenance Strategies

The operational analytics market is witnessing a shift towards predictive maintenance strategies, particularly in sectors such as manufacturing and transportation. Organizations are increasingly utilizing analytics to predict equipment failures and schedule maintenance proactively, thereby reducing downtime and maintenance costs. This trend is supported by the growing adoption of IoT devices, which generate vast amounts of data that can be analyzed for predictive insights. The operational analytics market is projected to see substantial growth as companies invest in predictive maintenance solutions, with estimates suggesting a market size increase of 30% by 2027. This shift not only enhances operational efficiency but also contributes to overall cost savings for businesses.