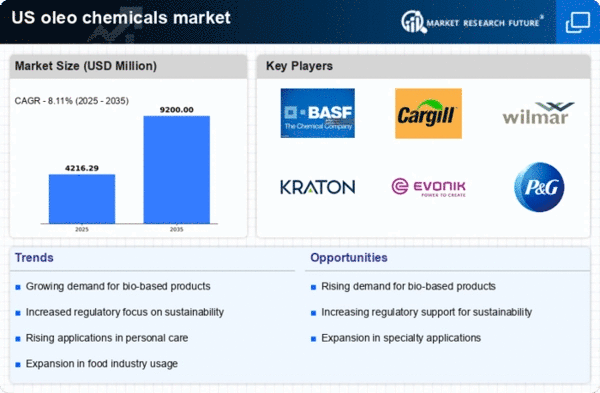

The oleo chemicals market is currently characterized by a dynamic competitive landscape, driven by increasing demand for sustainable and bio-based products. Key players are actively engaging in innovation and strategic partnerships to enhance their market positioning. Companies such as BASF SE (Germany), Cargill Inc (US), and Kraton Corporation (US) are at the forefront, focusing on product development and sustainability initiatives. Their collective strategies not only foster competition but also push the market towards more environmentally friendly solutions, indicating a shift in consumer preferences and regulatory pressures.In terms of business tactics, localizing manufacturing and optimizing supply chains appear to be critical for maintaining competitiveness. The market structure is moderately fragmented, with several players vying for market share. This fragmentation allows for niche players to thrive, while larger corporations leverage their scale to optimize operations and reduce costs. The influence of major companies is significant, as they set trends that smaller firms often follow, thereby shaping the overall market dynamics.

In October Cargill Inc (US) announced a partnership with a leading biotechnology firm to develop innovative bio-based oleo chemicals. This strategic move is expected to enhance Cargill's product portfolio and align with the growing consumer demand for sustainable alternatives. The collaboration signifies a commitment to research and development, potentially positioning Cargill as a leader in the bio-based segment of the market.

In September Kraton Corporation (US) launched a new line of renewable oleo chemicals derived from sustainable feedstocks. This initiative not only reflects Kraton's dedication to sustainability but also aims to capture a larger share of the growing market for eco-friendly products. The introduction of these products is likely to strengthen Kraton's competitive edge, appealing to environmentally conscious consumers and businesses alike.

In August BASF SE (Germany) expanded its production capacity for oleo chemicals in the US, investing approximately $50 million in state-of-the-art technology. This expansion is indicative of BASF's strategy to meet increasing demand while enhancing operational efficiency. By upgrading its facilities, BASF aims to improve its supply chain reliability and reduce production costs, thereby reinforcing its market position.

As of November the competitive trends in the oleo chemicals market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to innovate and meet evolving consumer demands. The competitive landscape is shifting from traditional price-based competition to a focus on innovation, technology, and supply chain reliability, suggesting that future differentiation will hinge on these critical factors.