Advancements in Drug Development

Innovations in drug development are significantly influencing the obstructive lung-disease market. The introduction of novel therapies, including biologics and targeted treatments, has transformed the management of obstructive lung diseases. For instance, the development of long-acting bronchodilators and inhaled corticosteroids has improved patient outcomes and adherence to treatment regimens. The market is projected to reach approximately $30 billion by 2026, driven by these advancements. Additionally, the increasing focus on combination therapies is likely to enhance treatment efficacy, further stimulating market growth. Pharmaceutical companies are investing heavily in clinical trials to explore new drug candidates, which may lead to a broader range of options for patients suffering from obstructive lung diseases.

Government Initiatives and Funding

Government initiatives aimed at improving respiratory health are playing a crucial role in the obstructive lung-disease market. Various federal and state programs are designed to enhance awareness, prevention, and treatment of lung diseases. For example, the National Heart, Lung, and Blood Institute (NHLBI) has launched campaigns to educate the public about COPD and asthma, which may lead to earlier diagnosis and treatment. Furthermore, increased funding for research into lung diseases is likely to foster innovation in therapeutic options. The US government has allocated substantial resources to combat respiratory diseases, which could potentially lead to breakthroughs in the obstructive lung-disease market. Such initiatives not only support patients but also encourage pharmaceutical companies to develop new treatments.

Increased Focus on Preventive Healthcare

The rising emphasis on preventive healthcare is influencing the obstructive lung-disease market. Healthcare providers are increasingly advocating for early detection and management of respiratory conditions to mitigate long-term complications. This shift is reflected in the growing adoption of screening programs and preventive measures, such as smoking cessation initiatives and vaccination campaigns. The CDC reports that smoking remains the leading cause of COPD, and efforts to reduce smoking rates are likely to have a positive impact on the obstructive lung-disease market. As awareness of the importance of prevention grows, there may be a corresponding increase in demand for diagnostic tools and preventive therapies, further driving market expansion.

Growing Demand for Home Healthcare Solutions

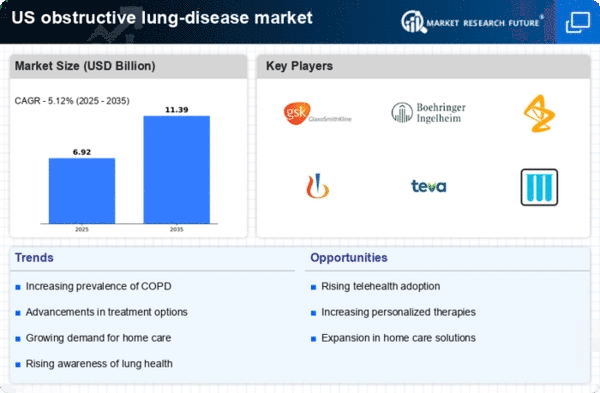

The shift towards home healthcare solutions is emerging as a significant driver in the obstructive lung-disease market. Patients increasingly prefer receiving care in the comfort of their homes, particularly those with chronic conditions like COPD. This trend is supported by advancements in telemedicine and portable medical devices, which facilitate remote monitoring and management of respiratory diseases. The market for home healthcare is expected to grow substantially, with estimates suggesting it could reach $200 billion by 2025. This demand for home-based care is likely to encourage the development of innovative products and services tailored to the needs of patients with obstructive lung diseases, thereby expanding the market.

Rising Prevalence of Obstructive Lung Diseases

The increasing incidence of obstructive lung diseases, such as chronic obstructive pulmonary disease (COPD) and asthma, is a primary driver of the obstructive lung-disease market. According to the Centers for Disease Control and Prevention (CDC), approximately 16 million Americans are diagnosed with COPD, and millions more may be undiagnosed. This growing patient population necessitates enhanced treatment options and management strategies, thereby propelling market growth. Furthermore, the aging population in the US, which is more susceptible to respiratory conditions, is expected to contribute to a rise in demand for therapeutic interventions. As the burden of these diseases escalates, healthcare providers and pharmaceutical companies are likely to invest more in research and development, leading to innovative solutions in the obstructive lung-disease market.