Emergence of Smart Home Technologies

The proliferation of smart home technologies is driving growth in the multi chip-module market. As consumers increasingly adopt smart devices for home automation, the demand for efficient and compact electronic solutions rises. Multi chip-modules facilitate the integration of various functionalities, such as connectivity, control, and sensing, into single units, making them ideal for smart home applications. The US smart home market is projected to exceed $100 billion by 2026, indicating a robust growth potential for multi chip-modules. This trend highlights the importance of multi chip-modules in enabling seamless communication and functionality among smart devices, positioning them as a vital component in the evolving landscape of home technology.

Miniaturization of Electronic Devices

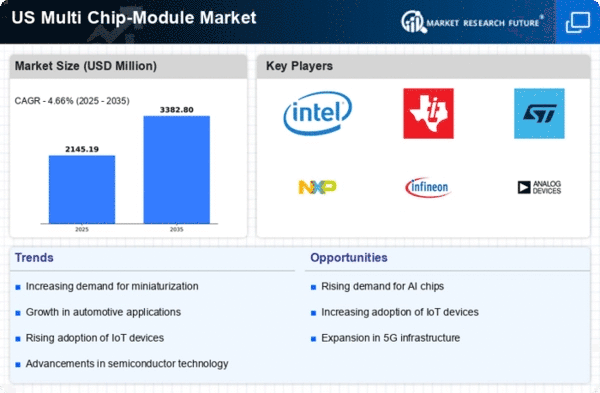

The trend towards miniaturization in electronics is significantly impacting the multi chip-module market. As consumer electronics, medical devices, and automotive applications demand smaller, more efficient components, multi chip-modules offer a viable solution. By integrating multiple chips into a single module, manufacturers can reduce size while maintaining performance. The US market for miniaturized electronic devices is expected to grow at a CAGR of 8% through 2026, which could lead to increased adoption of multi chip-modules. This trend not only enhances portability but also improves energy efficiency, making multi chip-modules an attractive option for manufacturers aiming to meet consumer expectations for compact and powerful devices.

Rising Adoption of Automotive Electronics

The automotive industry is increasingly incorporating advanced electronics. This trend is positively influencing the multi chip-module market. As vehicles become more connected and autonomous, the demand for sophisticated electronic systems rises. Multi chip-modules are essential for integrating various functionalities, such as infotainment, navigation, and safety systems, into a compact form factor. The US automotive electronics market is anticipated to reach $50 billion by 2027, with a significant portion attributed to multi chip-module applications. This trend suggests that as automotive technology continues to evolve, the multi chip-module market will likely see substantial growth driven by the need for enhanced electronic capabilities in vehicles.

Growth in Telecommunications Infrastructure

The expansion of telecommunications infrastructure in the US is a key driver for the multi chip-module market. With the rollout of 5G technology, there is a heightened need for advanced communication systems that can handle increased data traffic. Multi chip-modules play a crucial role in enabling faster and more reliable communication by integrating various functionalities into a single package. The telecommunications sector is projected to invest over $100 billion in infrastructure development by 2026, which is likely to create substantial opportunities for the multi chip-module market. As network demands evolve, the integration capabilities of multi chip-modules will be essential for supporting next-generation communication technologies.

Increasing Demand for High-Performance Computing

The multi chip-module market is experiencing a surge in demand driven by the need for high-performance computing solutions. Industries such as data centers, artificial intelligence, and machine learning are increasingly relying on multi chip-modules to enhance processing capabilities. In 2025, the market for high-performance computing is projected to reach approximately $50 billion in the US, indicating a robust growth trajectory. This demand is further fueled by the growing complexity of applications that require advanced processing power, which multi chip-modules can provide. As organizations seek to optimize their computing resources, the multi chip-module market is likely to benefit from this trend, positioning itself as a critical component in the technology landscape.