Growing Need for Remote Monitoring Solutions

The mobile video-surveillance market is propelled by the increasing need for remote monitoring solutions across various industries. Businesses are recognizing the value of being able to monitor their premises from anywhere, leading to a rise in demand for mobile surveillance systems that offer cloud connectivity and mobile access. This trend is particularly relevant for sectors such as retail, where loss prevention and customer safety are paramount. The market for remote monitoring solutions is expected to grow by approximately 20% in the coming years, as organizations seek to enhance security while reducing operational costs. The flexibility and convenience offered by mobile video-surveillance systems are likely to drive further adoption, making them an essential component of modern security strategies.

Increased Demand for Public Safety Solutions

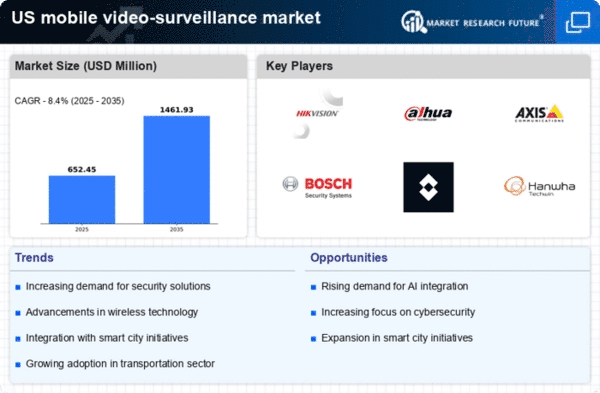

The mobile video-surveillance market experiences heightened demand due to the growing emphasis on public safety across urban areas in the US. Municipalities are increasingly investing in surveillance technologies to deter crime and enhance emergency response capabilities. According to recent data, the market is projected to grow at a CAGR of 15% over the next five years, driven by the need for real-time monitoring and incident management. This trend is particularly evident in cities that have implemented smart city initiatives, where integrated surveillance systems play a crucial role in maintaining public order. As local governments allocate more resources to security measures, The mobile video-surveillance market is likely to see substantial growth. This growth reflects a broader societal commitment to safety and security.

Technological Advancements in Surveillance Equipment

The mobile video-surveillance market is significantly influenced by rapid technological advancements in surveillance equipment. Innovations such as high-definition cameras, improved battery life, and enhanced connectivity options are making mobile surveillance solutions more effective and user-friendly. For instance, the introduction of 4G and 5G technologies has enabled faster data transmission, allowing for real-time video streaming and analysis. This evolution in technology not only enhances the quality of surveillance footage but also expands the potential applications of mobile video-surveillance systems in various sectors, including transportation, retail, and law enforcement. As these technologies continue to evolve, the market is expected to expand, with an estimated growth rate of 12% annually over the next few years.

Rising Adoption of Mobile Surveillance in Transportation

The mobile video-surveillance market is witnessing a surge in adoption within the transportation sector, particularly in fleet management and public transit systems. Companies are increasingly utilizing mobile surveillance solutions to monitor vehicle safety, ensure compliance with regulations, and enhance operational efficiency. The integration of mobile video systems in buses and trucks allows for real-time monitoring of driver behavior and passenger safety. Recent statistics indicate that the transportation segment accounts for approximately 30% of the overall market share, reflecting its critical role in the growth of mobile video-surveillance solutions. As transportation authorities and private companies prioritize safety and efficiency, the demand for mobile surveillance technologies is likely to continue its upward trajectory.

Enhanced Regulatory Frameworks Supporting Surveillance Technologies

The mobile video-surveillance market is positively impacted by enhanced regulatory frameworks that support the deployment of surveillance technologies. In the US, various federal and state regulations are being established to ensure that surveillance systems are used responsibly and ethically. These regulations often encourage the adoption of advanced surveillance solutions that comply with privacy standards while enhancing security measures. As organizations navigate these regulatory landscapes, they are more inclined to invest in mobile video-surveillance systems that align with compliance requirements. This trend is expected to foster market growth, as businesses and government entities seek to balance security needs with privacy considerations, potentially leading to a market expansion of around 10% over the next few years.