Growing Mobile Workforce

The rise of remote work and a mobile workforce in the US is significantly impacting the mobile encryption market. As employees increasingly access corporate data from various locations and devices, the need for secure mobile communication becomes paramount. According to recent studies, over 70% of employees now work remotely at least part-time, which necessitates the implementation of strong encryption measures to protect sensitive information. This shift towards a mobile-centric work environment suggests that organizations are prioritizing mobile encryption solutions to mitigate risks associated with data exposure. As a result, the mobile encryption market is poised for substantial growth as businesses adapt to this evolving landscape.

Rising Cybersecurity Threats

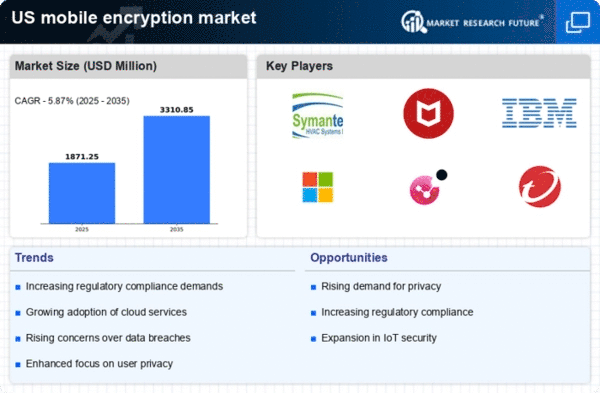

The mobile encryption market is experiencing growth due to the increasing frequency and sophistication of cyber threats. As organizations in the US face a surge in data breaches and cyberattacks, the demand for robust encryption solutions is escalating. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, prompting companies to invest heavily in mobile encryption technologies. This trend indicates a heightened awareness of the need for data protection, particularly for sensitive information accessed via mobile devices. Consequently, the mobile encryption market is likely to expand as businesses seek to safeguard their data against unauthorized access and ensure compliance with data protection regulations.

Consumer Awareness of Data Privacy

Consumer awareness regarding data privacy is driving the mobile encryption market in the US. With high-profile data breaches making headlines, individuals are becoming increasingly concerned about the security of their personal information. Surveys indicate that approximately 80% of consumers are more likely to choose services that offer strong encryption features. This growing demand for privacy-centric solutions is compelling businesses to adopt mobile encryption technologies to enhance customer trust and loyalty. As consumers continue to prioritize data protection, the mobile encryption market is expected to flourish, with companies investing in advanced encryption methods to meet these expectations.

Regulatory Pressures for Data Protection

Regulatory pressures for data protection are a key driver of the mobile encryption market in the US. With the implementation of stringent data protection laws, such as the California Consumer Privacy Act (CCPA), businesses are compelled to adopt encryption solutions to comply with legal requirements. Failure to adhere to these regulations can result in hefty fines, which may reach up to $7,500 per violation. This regulatory landscape is pushing organizations to prioritize mobile encryption as a means of safeguarding sensitive data and avoiding legal repercussions. Consequently, the mobile encryption market is likely to see increased investment as companies strive to meet compliance standards.

Technological Advancements in Encryption

Technological advancements in encryption methods are significantly influencing the mobile encryption market. Innovations such as quantum encryption and blockchain technology are emerging, offering enhanced security features that appeal to businesses and consumers alike. In 2025, the market for advanced encryption technologies is projected to reach $5 billion, reflecting a strong interest in cutting-edge solutions. These advancements not only improve the effectiveness of mobile encryption but also address the evolving nature of cyber threats. As organizations seek to stay ahead of potential vulnerabilities, the mobile encryption market is likely to benefit from the integration of these advanced technologies.