Growth of BYOD Policies

The mobile device-management market is witnessing a surge in adoption due to the widespread implementation of Bring Your Own Device (BYOD) policies. As employees increasingly use personal devices for work purposes, organizations face challenges in managing security and data integrity. The mobile device-management market provides solutions that enable businesses to secure and manage these devices effectively. In 2025, it is projected that over 70% of organizations will have adopted BYOD policies, necessitating robust mobile device-management strategies. This trend highlights the importance of balancing employee flexibility with organizational security, driving growth in the mobile device-management market.

Increased Mobile Workforce

The mobile device management market is expanding in response to the growing mobile workforce. As more employees work remotely or in the field, the need for effective management of mobile devices becomes paramount. In 2025, it is estimated that nearly 50% of the US workforce will be mobile, creating a demand for solutions that ensure secure access to corporate resources. Mobile device-management solutions facilitate this by providing centralized control over devices, applications, and data. This trend suggests that organizations are increasingly prioritizing mobile device-management to enhance productivity while maintaining security, thereby propelling growth in the mobile device-management market.

Rising Cybersecurity Threats

The mobile device-management market is experiencing heightened demand due to the increasing prevalence of cybersecurity threats. Organizations are recognizing the necessity of robust security measures to protect sensitive data accessed via mobile devices. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, prompting companies to invest in mobile device-management solutions. These solutions provide essential features such as remote wipe, encryption, and secure access controls, which are critical in safeguarding corporate information. As the mobile workforce expands, the mobile device-management market is likely to grow, driven by the urgent need for comprehensive security frameworks that can adapt to evolving threats.

Advancements in Mobile Technology

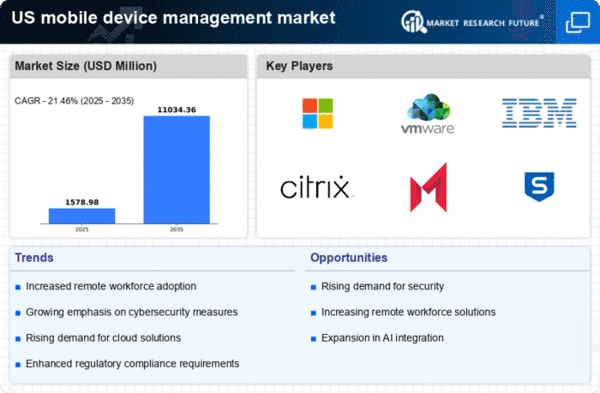

The mobile device management market is driven by rapid advancements in mobile technology. Innovations such as 5G connectivity, artificial intelligence, and machine learning are transforming how organizations manage mobile devices. These technologies enable more efficient data processing, improved security features, and enhanced user experiences. As businesses seek to leverage these advancements, the demand for sophisticated mobile device-management solutions is likely to increase. In 2025, the market is expected to grow at a CAGR of over 20%, reflecting the potential of these technological advancements to reshape the mobile device-management landscape.

Regulatory Compliance Requirements

The mobile device-management market is significantly influenced by the need for compliance with various regulatory frameworks. In the US, regulations such as HIPAA, GDPR, and CCPA impose strict guidelines on data protection and privacy. Organizations must ensure that their mobile devices comply with these regulations to avoid hefty fines, which can reach millions of dollars. As a result, businesses are increasingly adopting mobile device-management solutions to facilitate compliance through features like data encryption, access controls, and audit trails. This trend indicates a growing recognition of the importance of regulatory adherence in the mobile device-management market, driving investment in these technologies.