Emergence of Edge Computing

The emergence of edge computing is reshaping the microprocessor gpu market, as businesses seek to process data closer to the source. This shift reduces latency and enhances real-time data processing capabilities, making microprocessor GPUs essential for applications in IoT and smart devices. The edge computing market is anticipated to grow at a CAGR of 30% through 2027, driving demand for efficient microprocessor GPUs that can handle localized processing tasks. As industries increasingly adopt edge computing solutions, the microprocessor gpu market stands to gain from this transformative trend, as it aligns with the need for faster and more efficient data processing.

Surge in Data Center Demand

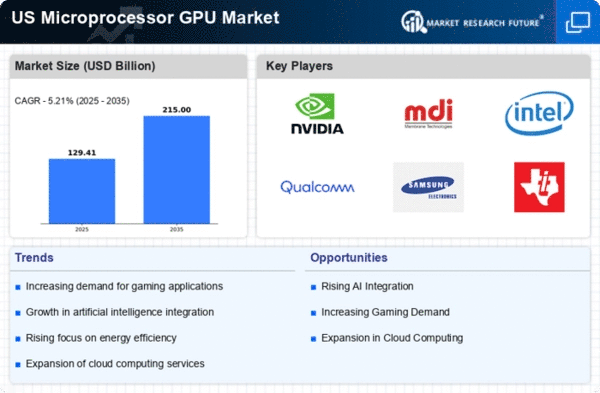

The microprocessor gpu market experiences a notable surge in demand driven by the expansion of data centers across the United States. As organizations increasingly rely on cloud computing and big data analytics, the need for high-performance computing solutions becomes paramount. Microprocessor GPUs are integral to processing vast amounts of data efficiently, leading to a projected market growth of approximately 15% annually. This trend is further fueled by the rise of machine learning applications, which require advanced graphical processing capabilities. Consequently, the microprocessor gpu market is positioned to benefit significantly from this data center boom, as companies invest heavily in infrastructure to support their digital transformation initiatives.

Advancements in Gaming Technology

The microprocessor gpu market is significantly influenced by advancements in gaming technology, particularly in the realm of high-definition graphics and immersive experiences. The gaming industry in the United States is projected to reach a valuation of over $200 billion by 2026, with a substantial portion attributed to the demand for cutting-edge GPUs. As gamers seek enhanced visual fidelity and performance, manufacturers are compelled to innovate, leading to the development of more powerful microprocessor GPUs. This competitive landscape not only drives sales but also encourages continuous improvement in GPU technology, thereby propelling the microprocessor gpu market forward.

Increased Adoption of Machine Learning

The microprocessor gpu market is witnessing increased adoption of machine learning technologies across various sectors, including finance, healthcare, and automotive. Organizations are leveraging the parallel processing capabilities of microprocessor GPUs to accelerate machine learning algorithms, resulting in faster data analysis and improved decision-making processes. This trend is expected to contribute to a compound annual growth rate (CAGR) of around 20% for the microprocessor gpu market over the next five years. As more businesses recognize the value of data-driven insights, the demand for microprocessor GPUs is likely to escalate, further solidifying their role in the technological landscape.

Growing Interest in Cryptocurrency Mining

The growing interest in cryptocurrency mining has a profound impact on the microprocessor gpu market. As cryptocurrencies gain traction, miners require powerful GPUs to solve complex algorithms and validate transactions. The demand for high-performance microprocessor GPUs has surged, with some models experiencing price increases of over 50% due to scarcity. This trend is likely to continue as more individuals and organizations enter the cryptocurrency space, further driving the microprocessor gpu market. The interplay between cryptocurrency mining and GPU availability may also influence market dynamics, creating both opportunities and challenges for manufacturers.