Rising Fuel Costs

The marine scrubber market is also influenced by the rising costs of marine fuels, particularly low-sulfur fuel oils. As fuel prices fluctuate, ship operators are increasingly looking for cost-effective solutions to manage their fuel expenses. The implementation of scrubbers allows vessels to continue using high-sulfur fuel oil (HSFO), which is generally cheaper than low-sulfur alternatives. This economic incentive is driving the adoption of scrubbers, as operators can potentially save up to 30% on fuel costs by utilizing HSFO. Consequently, the marine scrubber market is likely to see a surge in demand as shipping companies seek to optimize their operational costs while adhering to environmental regulations.

Increasing Regulatory Pressure

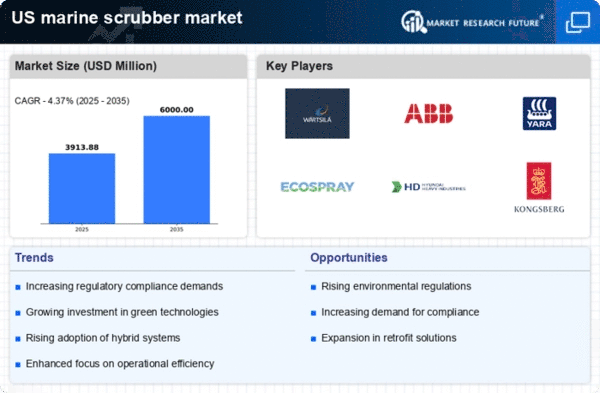

Heightened regulatory pressure from both federal and state authorities in the US is affecting the marine scrubber market. This pressure is primarily driven by the need to comply with stringent emissions standards set forth by the Environmental Protection Agency (EPA) and the International Maritime Organization (IMO). As regulations become more rigorous, ship operators are compelled to invest in marine scrubber technology to avoid hefty fines and ensure compliance. The market is projected to grow as more vessels are retrofitted with scrubbers to meet the 2020 sulfur cap regulations, which limit sulfur content in marine fuels to 0.5%. This regulatory landscape is likely to propel the marine scrubber market forward, as non-compliance could result in significant operational disruptions and financial penalties.

Enhanced Awareness of Environmental Impact

There is a growing awareness among stakeholders regarding the environmental impact of shipping activities, which is significantly influencing the marine scrubber market. As public scrutiny increases, shipping companies are under pressure to adopt cleaner technologies to mitigate their environmental footprint. This heightened awareness is leading to a shift in consumer preferences, with many customers favoring companies that demonstrate a commitment to sustainability. Consequently, the marine scrubber market is likely to benefit from this trend, as more operators seek to implement scrubbers as part of their environmental strategy. This shift not only aligns with regulatory requirements but also enhances the overall reputation of shipping companies in an increasingly eco-conscious market.

Growing Investment in Sustainable Shipping

The marine scrubber market is witnessing a surge in investment. Stakeholders are increasingly prioritizing sustainable shipping practices. Shipping companies are recognizing the importance of reducing their carbon footprint and enhancing their environmental performance. This shift towards sustainability is prompting significant investments in marine scrubber technology, as it represents a viable solution for meeting emissions targets. According to industry estimates, the market is expected to reach approximately $10 billion by 2027, driven by the growing demand for eco-friendly shipping solutions. This trend indicates a strong commitment from the maritime industry to adopt cleaner technologies, thereby fostering growth in the marine scrubber market.

Technological Innovations in Scrubber Design

Technological innovations are playing a crucial role in shaping the marine scrubber market. Advances in scrubber design and efficiency are enabling operators to achieve better performance with lower operational costs. For instance, the development of hybrid scrubbers, which can operate in both open and closed loop modes, offers flexibility and adaptability to varying environmental conditions. These innovations not only enhance the effectiveness of scrubbers in reducing emissions but also contribute to the overall sustainability of maritime operations. As technology continues to evolve, the marine scrubber market is expected to benefit from increased efficiency and reduced maintenance costs, making it a more attractive option for ship operators.