Expansion of End-User Industries

the expansion of end-users is a critical driver for the laser processings market.. Sectors such as healthcare, automotive, and electronics are increasingly utilizing laser technologies for various applications, including surgical procedures, component manufacturing, and product marking. The healthcare industry, in particular, is leveraging laser processing for minimally invasive surgeries and diagnostic tools, which is expected to grow at a CAGR of 10% through 2025. This diversification across multiple industries not only broadens the market's customer base but also enhances the demand for innovative laser solutions, thereby stimulating growth in the laser processings market.

Rising Demand in Manufacturing Sector

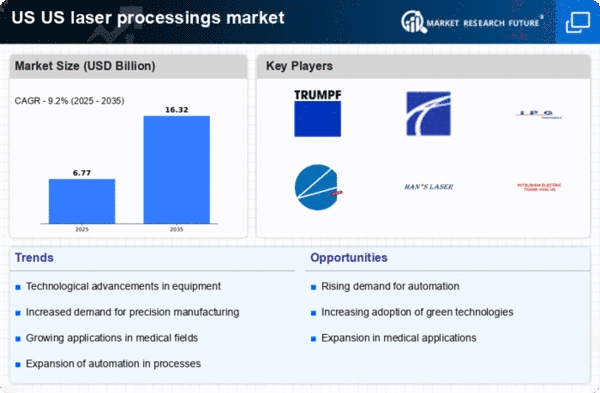

The manufacturing sector in the US is experiencing a notable surge in demand for precision and efficiency, which is driving growth in the laser processings market. Industries such as automotive, aerospace, and electronics are increasingly adopting laser technologies for cutting, welding, and engraving applications. This shift is largely attributed to the need for high-quality production and reduced operational costs. In 2025, the market is projected to reach approximately $5 billion, reflecting a compound annual growth rate (CAGR) of around 8%. The ability of laser processing to enhance production speed and accuracy positions it as a preferred choice among manufacturers, thereby propelling the overall market forward.

Technological Advancements in Laser Systems

Technological advancements are playing a pivotal role in shaping the laser processings market. Innovations in laser sources, such as fiber lasers and ultrafast lasers, are enhancing the capabilities of laser systems, allowing for more complex and precise applications. These advancements are not only improving efficiency but also expanding the range of materials that can be processed. For instance, fiber lasers are known for their energy efficiency and versatility, making them suitable for various industrial applications. As of 2025, the integration of these advanced technologies is expected to contribute significantly to market growth, with projections indicating a potential increase in market value by 15% over the next five years.

Regulatory Support and Standards Development

Regulatory support and the development of industry standards are emerging as influential factors in the laser processings market. Government initiatives aimed at promoting advanced manufacturing technologies are encouraging the adoption of laser processing solutions. Additionally, the establishment of safety and quality standards is fostering confidence among manufacturers and end-users. As regulations evolve, they are likely to create a more structured environment for the laser processings market, facilitating growth. By 2025, it is expected that compliance with these standards will enhance market credibility and drive further investment in laser technologies, potentially increasing market size by 12%.

Growing Investment in Research and Development

Investment in research and development (R&D) within the laser processings market is witnessing a substantial increase, driven by the need for innovation and competitive advantage. Companies are allocating significant resources to develop new laser technologies and improve existing ones. This trend is particularly evident in sectors such as medical devices and electronics, where precision and reliability are paramount. In 2025, R&D expenditures in the laser processings market are anticipated to exceed $1 billion, reflecting a commitment to advancing laser technology. This focus on R&D is likely to yield new applications and enhance the overall efficiency of laser processing, thereby fostering market expansion.