Rising Demand for Durable Labels

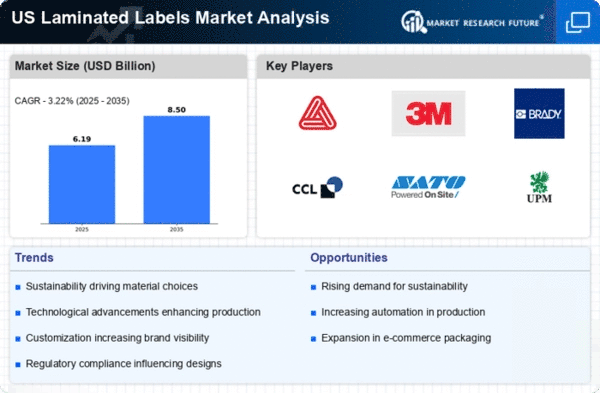

The laminated labels market is experiencing a notable increase in demand for durable labeling solutions across various industries. This trend is driven by the need for labels that can withstand harsh environmental conditions, including moisture, chemicals, and abrasion. Industries such as food and beverage, pharmaceuticals, and logistics are particularly focused on utilizing laminated labels to ensure product integrity and compliance with safety standards. The market for laminated labels is projected to grow at a CAGR of approximately 5.2% from 2025 to 2030, indicating a robust expansion in response to these durability requirements. As companies prioritize quality and longevity in their labeling solutions, the laminated labels market is likely to benefit significantly from this shift in consumer preferences.

Increased Focus on Brand Identity

In the laminated labels market, there is a growing emphasis on brand identity and consumer engagement. Companies are recognizing the importance of visually appealing labels that convey brand values and attract consumer attention. This trend is particularly evident in the food and beverage industry, where packaging plays a crucial role in influencing purchasing decisions. As a result, businesses are investing in high-quality laminated labels that not only enhance aesthetics but also provide essential product information. The market for laminated labels is expected to witness a surge in demand as brands strive to differentiate themselves in a competitive landscape, potentially leading to a market growth rate of around 4.8% annually.

Regulatory Requirements for Labeling

The laminated labels market is influenced by stringent regulatory requirements that govern labeling practices across various industries. Compliance with these regulations is essential for businesses to avoid penalties and ensure product safety. Industries such as pharmaceuticals and food and beverage are particularly affected by these regulations, which mandate clear and accurate labeling of products. As companies strive to meet these requirements, the demand for high-quality laminated labels that can withstand scrutiny is likely to increase. This focus on compliance not only drives market growth but also encourages innovation in label design and materials, positioning the laminated labels market for continued expansion.

Technological Innovations in Printing

The laminated labels market is benefiting from technological innovations in printing techniques, which are enhancing the quality and efficiency of label production. Advances in digital printing technology allow for greater customization and shorter production runs, catering to the diverse needs of businesses. This shift towards digital solutions is likely to reduce lead times and costs associated with traditional printing methods. Furthermore, the integration of smart technologies, such as QR codes and NFC tags, into laminated labels is becoming increasingly popular, providing added value to consumers. As these technologies continue to evolve, the laminated labels market is expected to expand, driven by the demand for innovative labeling solutions.

Growth in E-commerce and Retail Sectors

The laminated labels market is poised for growth due to the rapid expansion of e-commerce and retail sectors in the United States. As online shopping continues to gain traction, businesses are increasingly utilizing laminated labels for packaging and shipping purposes. These labels not only enhance product presentation but also provide essential information regarding handling and storage. The e-commerce sector alone is expected to reach $1 trillion by 2025, which could lead to a substantial increase in demand for laminated labels. This growth is further supported by the need for efficient inventory management and branding, making laminated labels a critical component in the supply chain of retail and e-commerce businesses.