Rising Prevalence of Keratoconus

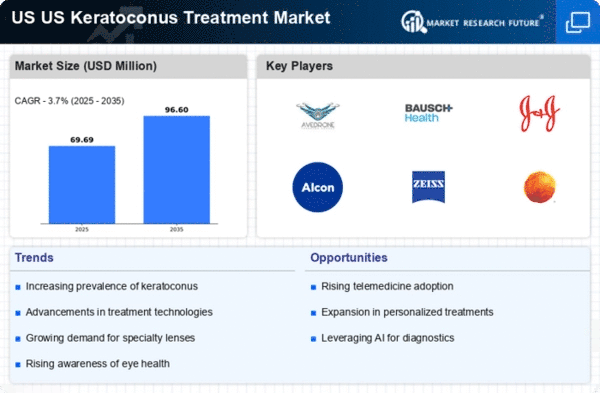

The US Keratoconus Treatment Market is experiencing growth due to the increasing prevalence of keratoconus among the population. Recent estimates suggest that keratoconus affects approximately 1 in 2,000 individuals in the United States, with higher rates observed in certain demographics. This rising incidence necessitates effective treatment options, driving demand for innovative therapies and surgical interventions. As awareness of the condition grows, more patients are seeking diagnosis and treatment, further propelling market expansion. The increasing number of eye care professionals specializing in keratoconus management also contributes to the industry's growth, as they are better equipped to provide tailored treatment plans for affected individuals.

Technological Innovations in Treatment

Technological advancements are significantly influencing the US Keratoconus Treatment Market. Innovations such as corneal cross-linking, topography-guided treatments, and advanced contact lens designs are revolutionizing the management of keratoconus. For instance, corneal cross-linking has emerged as a standard treatment option, with studies indicating its effectiveness in halting disease progression in up to 90% of patients. Additionally, the development of custom-fit scleral lenses has improved visual outcomes for many individuals with keratoconus. These technological breakthroughs not only enhance patient outcomes but also stimulate market growth by attracting investment and encouraging research and development in the field of ophthalmology.

Growing Demand for Personalized Medicine

The trend towards personalized medicine is becoming increasingly prominent within the US Keratoconus Treatment Market. Patients are seeking tailored treatment plans that address their specific needs and conditions. This shift is driven by advancements in diagnostic technologies, which allow for more precise assessments of keratoconus severity and progression. As a result, eye care professionals are better equipped to recommend individualized treatment options, such as customized contact lenses or specific surgical interventions. The growing emphasis on personalized care not only improves patient satisfaction but also enhances treatment efficacy, thereby driving market growth as more patients seek specialized care.

Government Support and Regulatory Framework

The US Keratoconus Treatment Market benefits from supportive government policies and a robust regulatory framework. The Food and Drug Administration (FDA) plays a crucial role in approving new treatments and technologies, ensuring that patients have access to safe and effective options. Recent initiatives aimed at improving eye health and increasing funding for research into keratoconus treatments have further bolstered the market. Additionally, the establishment of guidelines for the management of keratoconus by professional organizations promotes standardized care, which can enhance treatment outcomes and patient satisfaction. This supportive environment encourages innovation and investment in the keratoconus treatment sector.

Increased Collaboration Among Healthcare Providers

Collaboration among healthcare providers is emerging as a key driver in the US Keratoconus Treatment Market. Interdisciplinary approaches involving ophthalmologists, optometrists, and other healthcare professionals are becoming more common, leading to improved patient outcomes. This collaborative model facilitates comprehensive care, ensuring that patients receive timely diagnoses and appropriate treatments. Furthermore, partnerships between academic institutions and industry stakeholders are fostering research and development of new therapies and technologies for keratoconus. As these collaborations expand, they are likely to enhance the overall quality of care and stimulate growth within the keratoconus treatment market.