Demographic Shifts

Demographic shifts in the United States are influencing the insurance protection-product market significantly. As the population ages, there is a growing demand for products that cater to the needs of older adults, such as long-term care insurance and life insurance. Data shows that individuals aged 65 and older are projected to represent 20% of the population by 2030, creating a substantial market for age-specific insurance products. Additionally, younger generations are increasingly seeking insurance solutions that align with their values, such as sustainability and social responsibility. This evolving demographic landscape presents both challenges and opportunities for insurers, as they must adapt their offerings to meet the diverse needs of a changing consumer base.

Regulatory Changes

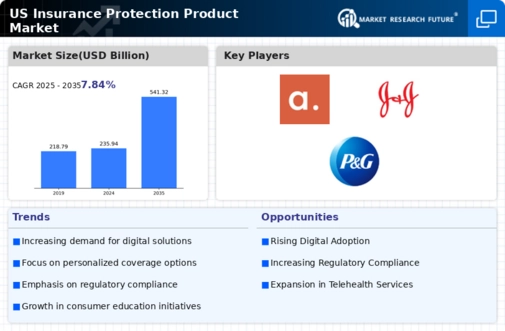

Regulatory changes are a significant driver in the insurance protection-product market. The evolving legal landscape often necessitates adjustments in product offerings and compliance strategies for insurers. Recent legislative developments have introduced new requirements for transparency and consumer protection, which can impact how products are marketed and sold. For instance, regulations mandating clearer disclosures have led to a 10% increase in consumer trust in insurance products. Insurers must remain vigilant and adaptable to these changes, as non-compliance can result in substantial penalties. Consequently, the ability to navigate regulatory complexities is crucial for companies operating in the insurance protection-product market, influencing their operational strategies and market positioning.

Economic Uncertainty

Economic fluctuations have a profound impact on the insurance protection-product market. In times of economic uncertainty, individuals and businesses tend to prioritize risk management, leading to an increased demand for insurance products. Recent data suggests that during economic downturns, the market for protection products can expand by as much as 20%. This trend is driven by the need for financial security and the desire to mitigate potential losses. As consumers seek to safeguard their assets, insurance providers are likely to see a surge in policy purchases. This dynamic creates opportunities for growth within the insurance protection-product market, as companies develop strategies to address the evolving needs of their clients amid economic challenges.

Rising Consumer Awareness

The insurance protection-product market is experiencing a notable increase in consumer awareness regarding the importance of financial security. As individuals become more informed about potential risks, they are actively seeking insurance products that provide comprehensive coverage. This heightened awareness is reflected in a 15% growth in inquiries about various protection products over the past year. Consumers are now more inclined to compare policies and seek tailored solutions that meet their specific needs. This trend indicates a shift towards a more educated consumer base, which is likely to drive demand for innovative insurance solutions. Consequently, companies in the insurance protection-product market are adapting their offerings to align with consumer expectations, thereby enhancing their competitive edge.

Technological Advancements

Technological advancements are reshaping the landscape of the insurance protection-product market. The integration of digital platforms and data analytics is enabling insurers to offer more personalized products and streamline the claims process. Recent statistics indicate that approximately 30% of consumers prefer to purchase insurance online, highlighting a shift towards digital engagement. This trend not only enhances customer experience but also allows insurers to reduce operational costs. As technology continues to evolve, the insurance protection-product market is likely to witness increased competition, with companies leveraging innovative solutions to attract and retain customers. The ability to harness technology effectively may become a critical factor for success in this dynamic market.