Advancements in Automation

Automation continues to reshape the landscape of the inspection analysis-device market. The integration of automated systems into inspection processes enhances efficiency and accuracy, reducing human error. In 2025, it is estimated that automated inspection devices will account for over 40% of the market share, driven by the need for faster production cycles and real-time data analysis. Industries such as manufacturing and food processing are particularly influenced by this trend, as they seek to streamline operations and ensure compliance with safety regulations. The inspection analysis-device market is likely to see significant advancements in automation technologies, which could further propel market growth.

Increased Investment in R&D

Investment in research and development (R&D) is a critical driver for the inspection analysis-device market. Companies are increasingly allocating resources to innovate and develop cutting-edge inspection technologies. In 2025, R&D spending in this sector is projected to exceed $500 million, reflecting a commitment to enhancing device capabilities and performance. This trend is particularly evident in sectors such as electronics and medical devices, where precision is essential. The inspection analysis-device market stands to gain from these investments, as new technologies emerge that improve inspection accuracy and efficiency, ultimately benefiting end-users.

Emergence of Smart Technologies

The emergence of smart technologies is transforming the inspection analysis-device market. The integration of Internet of Things (IoT) capabilities into inspection devices allows for real-time monitoring and data collection, enhancing decision-making processes. By 2025, it is expected that smart inspection devices will represent a substantial portion of the market, driven by the demand for connectivity and data analytics. Industries such as manufacturing and logistics are increasingly adopting these technologies to optimize operations and improve product quality. The inspection analysis-device market is poised to benefit from this trend, as smart technologies offer innovative solutions to traditional inspection challenges.

Growing Focus on Safety Standards

The inspection analysis-device market is significantly influenced by the growing focus on safety standards across various industries. Regulatory bodies are implementing stricter safety regulations, compelling companies to adopt advanced inspection technologies to ensure compliance. In 2025, it is anticipated that the market will see a 10% increase in demand for devices that meet these enhanced safety standards. Industries such as construction and food production are particularly affected, as they must adhere to rigorous safety protocols. The inspection analysis-device market is thus likely to expand as businesses invest in reliable inspection solutions to mitigate risks and enhance safety.

Rising Demand for Quality Assurance

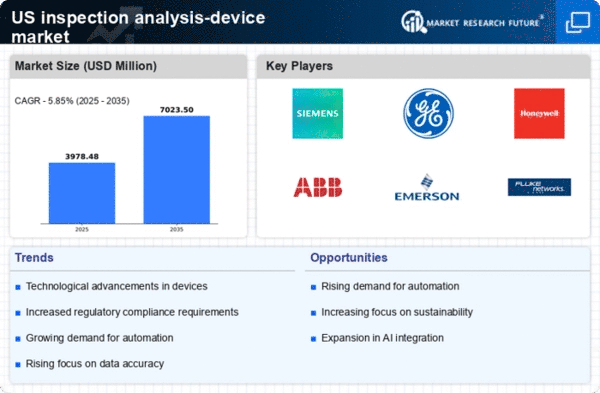

The inspection analysis-device market experiences a notable surge in demand driven by the increasing emphasis on quality assurance across various industries. As manufacturers strive to meet stringent quality standards, the need for advanced inspection devices becomes paramount. In 2025, the market is projected to reach approximately $3 billion, reflecting a growth rate of around 8% annually. This growth is largely attributed to sectors such as automotive, aerospace, and pharmaceuticals, where precision and reliability are critical. The inspection analysis-device market is thus positioned to benefit from this trend, as companies invest in sophisticated technologies to enhance product quality and minimize defects.