Growth of the Manufacturing Sector

The expansion of the manufacturing sector in the United States significantly influences the industrial metrology market. As manufacturing activities ramp up, the demand for reliable measurement solutions to ensure product quality and compliance with industry standards intensifies. In 2025, the manufacturing sector is anticipated to contribute approximately $2 trillion to the US economy, creating a robust environment for metrology services and equipment. This growth necessitates the implementation of advanced metrology systems to monitor production processes effectively. Consequently, the industrial metrology market is poised for growth, driven by the increasing need for precision and quality assurance in manufacturing.

Rising Demand for Precision Engineering

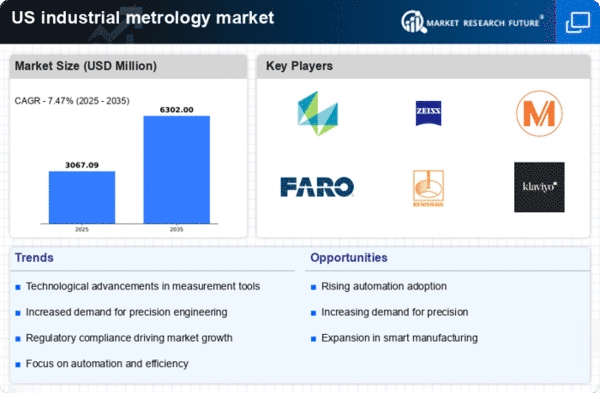

The industrial metrology market experiences a notable surge in demand for precision engineering across various sectors, including aerospace, automotive, and manufacturing. As industries increasingly prioritize accuracy in production processes, the need for advanced measurement solutions becomes paramount. In 2025, the market is projected to reach approximately $3 billion, reflecting a compound annual growth rate (CAGR) of around 7% from previous years. This growth is driven by the necessity for high-quality products and the reduction of waste, which ultimately enhances operational efficiency. Consequently, companies are investing in sophisticated metrology equipment to ensure compliance with stringent quality standards, thereby propelling the industrial metrology market forward.

Technological Advancements in Measurement Tools

Technological innovations play a crucial role in shaping the industrial metrology market. The introduction of cutting-edge measurement tools, such as laser scanning and 3D measurement systems, enhances the accuracy and efficiency of inspections. These advancements allow for real-time data collection and analysis, which is essential for maintaining quality control in manufacturing processes. In 2025, the market for these advanced tools is expected to account for a significant share, driven by the increasing complexity of products and the need for precise measurements. As industries adopt these technologies, the industrial metrology market is likely to witness substantial growth, reflecting the ongoing evolution of measurement practices.

Increasing Investment in Research and Development

Investment in research and development (R&D) is a critical driver of innovation within the industrial metrology market. Companies are allocating substantial resources to develop new measurement technologies and improve existing solutions. This focus on R&D is essential for addressing the evolving needs of various industries, including automotive and aerospace, where precision is paramount. In 2025, it is estimated that R&D spending in the metrology sector will increase by approximately 10%, reflecting the industry's commitment to advancing measurement capabilities. As a result, the industrial metrology market is likely to benefit from enhanced product offerings and improved measurement accuracy.

Emphasis on Sustainability and Environmental Standards

The industrial metrology market is increasingly impacted by the growing emphasis on sustainability and environmental standards. Companies are under pressure to minimize their environmental footprint while maintaining product quality. This trend drives the adoption of metrology solutions that facilitate compliance with environmental regulations and promote sustainable practices. In 2025, the market is expected to see a rise in demand for measurement tools that support eco-friendly manufacturing processes. By integrating metrology into sustainability initiatives, organizations can enhance their operational efficiency and reduce waste, thereby fostering growth in the industrial metrology market.