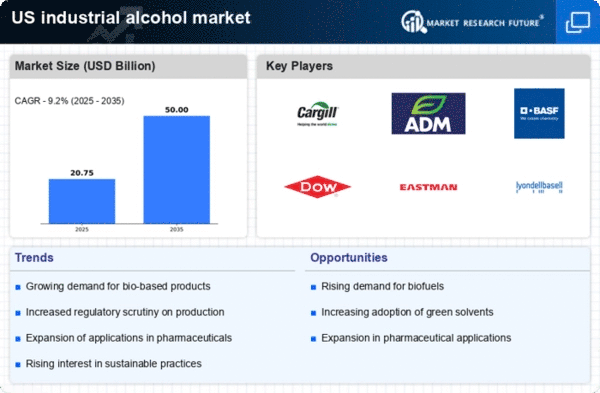

The industrial alcohol market is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Cargill (US), Archer Daniels Midland (US), and BASF (DE) are actively pursuing strategies that emphasize product diversification and technological advancements. Cargill (US), for instance, focuses on enhancing its bio-based product offerings, which aligns with the growing demand for sustainable solutions. Meanwhile, Archer Daniels Midland (US) is investing in digital transformation initiatives to optimize its supply chain and improve operational efficiency. These strategies collectively contribute to a dynamic competitive environment, where companies are not only vying for market share but also striving to meet evolving consumer preferences for eco-friendly products.In terms of business tactics, companies are increasingly localizing manufacturing to reduce transportation costs and enhance supply chain resilience. This approach appears to be particularly effective in a moderately fragmented market, where the collective influence of major players like Dow (US) and Eastman Chemical Company (US) is significant. The competitive structure is evolving, with these companies leveraging their extensive distribution networks and technological capabilities to maintain a competitive edge. Supply chain optimization remains a critical focus, as firms seek to mitigate risks and enhance their responsiveness to market demands.

In October Dow (US) announced a strategic partnership with a leading renewable energy firm to develop low-carbon industrial alcohol production methods. This initiative is poised to significantly reduce the carbon footprint associated with alcohol manufacturing, aligning with global sustainability goals. The partnership underscores Dow's commitment to innovation and positions the company as a leader in the transition towards greener production processes.

In September Eastman Chemical Company (US) launched a new line of bio-based solvents derived from renewable resources. This product line not only caters to the increasing demand for sustainable alternatives but also enhances Eastman's portfolio in the industrial alcohol sector. The introduction of these solvents is expected to strengthen the company's market position and appeal to environmentally conscious consumers and businesses alike.

In August BASF (DE) expanded its production capacity for industrial alcohols in North America, responding to the rising demand from various end-use industries. This expansion is indicative of BASF's strategic focus on regional growth and its intent to capitalize on the burgeoning market opportunities. By increasing its production capabilities, BASF aims to solidify its presence in the market and enhance its competitive stance against other key players.

As of November the industrial alcohol market is witnessing trends that emphasize digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming increasingly vital, as companies collaborate to enhance their innovation capabilities and market reach. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on technological advancements, sustainability initiatives, and supply chain reliability. This shift suggests that companies that prioritize innovation and sustainable practices will be better positioned to thrive in the future.