Rise of Managed Services

The hosting infrastructure-services market is witnessing a significant shift towards managed services. Organizations are increasingly outsourcing their IT infrastructure management to specialized providers, allowing them to focus on core business activities. This trend is fueled by the complexity of managing hosting environments and the need for expert support. Managed services are expected to account for approximately 40% of the total market by 2026. As businesses recognize the value of leveraging external expertise, the demand for managed hosting solutions continues to rise, driving growth in the hosting infrastructure-services market.

Growing Cybersecurity Concerns

Cybersecurity remains a paramount concern for businesses, significantly impacting the hosting infrastructure-services market. With the rise in cyber threats, organizations are prioritizing secure hosting solutions to protect sensitive data. This heightened focus on security is driving demand for hosting providers that offer robust security measures, including encryption, firewalls, and compliance with industry standards. It is estimated that the market for secure hosting services will grow by 20% annually as businesses seek to mitigate risks. The emphasis on cybersecurity is reshaping the competitive landscape of the hosting infrastructure-services market, compelling providers to enhance their security offerings.

Increased Focus on Sustainability

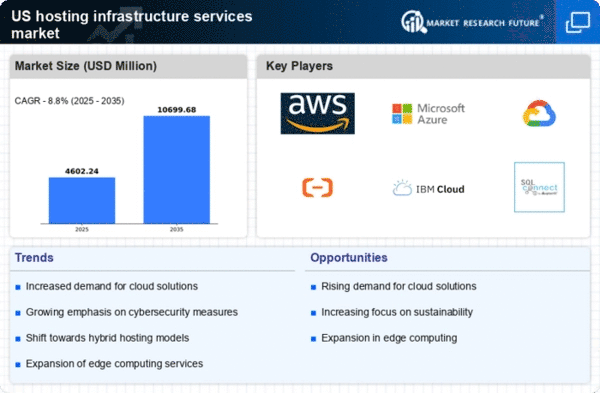

Sustainability has emerged as a critical driver in the hosting infrastructure-services market. Companies are increasingly prioritizing eco-friendly practices, seeking hosting solutions that minimize environmental impact. This shift is influenced by both regulatory pressures and consumer preferences for sustainable operations. Hosting providers are responding by investing in energy-efficient technologies and renewable energy sources. It is estimated that by 2027, 50% of hosting services will be powered by renewable energy. This focus on sustainability not only enhances brand reputation but also aligns with the growing demand for responsible business practices in the hosting infrastructure-services market.

Growing Demand for Scalable Solutions

The hosting infrastructure-services market experiences a notable surge in demand for scalable solutions. Businesses increasingly seek flexible hosting options that can adapt to their evolving needs. This trend is driven by the necessity for organizations to manage fluctuating workloads efficiently. According to recent data, the market for scalable hosting solutions is projected to grow at a CAGR of 15% over the next five years. Companies are prioritizing infrastructure that can seamlessly scale up or down, allowing them to optimize costs while maintaining performance. This growing demand for scalability is reshaping the hosting infrastructure-services market, compelling providers to innovate and offer more dynamic solutions.

Advancements in Technology Integration

Technological advancements play a pivotal role in shaping the hosting infrastructure-services market. The integration of artificial intelligence, machine learning, and automation into hosting solutions is transforming service delivery. These technologies enhance operational efficiency, improve resource allocation, and enable predictive analytics for better decision-making. As organizations increasingly adopt these innovations, the hosting infrastructure-services market is expected to expand significantly. By 2025, it is projected that 30% of hosting services will incorporate advanced technologies, reflecting a shift towards more intelligent and responsive hosting environments.