Us Graphene Size

US Graphene Market Growth Projections and Opportunities

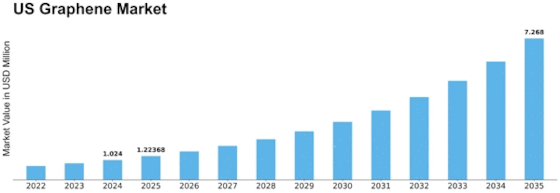

US Graphene Market Size was valued at USD 0.6 Billion in 2022. The graphene industry is projected to grow from USD 0.75 Billion in 2023 to USD 3.121 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 19.50%

The US Graphene Market is influenced by a myriad of market factors that collectively contribute to its growth and evolution. One of the primary drivers is the increasing focus on technological advancements and innovations. Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, possesses remarkable properties, including high conductivity, strength, and flexibility. As a result, it has gained significant attention in various industries, such as electronics, energy storage, and materials science. The ongoing pursuit of cutting-edge technologies and the demand for high-performance materials drive the exploration and adoption of graphene-based solutions in the US market.

Moreover, research and development activities play a pivotal role in shaping the US Graphene Market. Academic institutions, research organizations, and private companies are actively engaged in exploring the potential applications of graphene. As research uncovers new properties and functionalities of graphene, it opens up opportunities for commercialization in diverse sectors. The collaborative efforts between academia and industry contribute to the growth of the graphene market by expanding the range of applications and driving innovation in graphene-based products.

Government initiatives and funding support also influence the graphene market dynamics. Governments at various levels recognize the strategic importance of graphene in advancing technology and promoting economic development. Funding programs and initiatives aimed at supporting graphene research and commercialization contribute to the overall growth of the market. Public-private partnerships foster collaboration between governmental bodies and industry players, creating an environment conducive to the development and commercialization of graphene-based technologies.

Market factors related to the semiconductor and electronics industries are key drivers for the graphene market in the US. With the relentless pursuit of smaller, faster, and more efficient electronic devices, graphene's exceptional electrical conductivity and other unique properties make it a promising material for applications such as transistors, sensors, and flexible electronics. The demand for graphene in these industries is driven by the need for materials that can push the boundaries of current technology.

Environmental considerations and sustainability also play a role in shaping the graphene market. Graphene's potential applications in energy storage, water purification, and environmental monitoring align with the growing emphasis on sustainable technologies. Researchers and industries are exploring graphene's use in developing eco-friendly solutions, contributing to a more sustainable and environmentally conscious market.

Market competition and industry collaborations contribute to the dynamics of the US Graphene Market. The market features both established companies and startups, fostering a competitive landscape. Collaborations and partnerships between graphene producers, researchers, and end-users facilitate the development of practical applications and enhance the commercialization prospects of graphene-based products. Market players are exploring synergies to leverage each other's expertise and contribute to the overall growth of the graphene market.

The influence of global economic conditions and trade dynamics is also notable in the graphene market. As a globally traded commodity, market participants in the US closely monitor international developments, trade agreements, and geopolitical factors that may impact the supply chain and market conditions. Economic stability and trade policies play a role in determining the accessibility of graphene materials and products in the US market.

Challenges related to graphene production scalability and cost-effectiveness are factors that industry participants navigate. While graphene exhibits exceptional properties at the nanoscale, achieving large-scale production and integrating it into cost-effective commercial products present ongoing challenges. Overcoming these challenges is crucial for the widespread adoption of graphene in various industries.

Leave a Comment