Expansion of Golf Courses and Resorts

The expansion of golf courses and resorts across the US is significantly impacting the golf cart market. As new facilities are developed, the demand for golf carts increases, as they are essential for transporting players and equipment. According to industry reports, the number of golf courses in the US has seen a steady increase, with over 15,000 courses currently operational. This growth not only boosts sales of golf carts but also encourages manufacturers to innovate and improve their offerings. The golf cart market is likely to benefit from this trend, as more facilities seek to enhance the player experience through efficient transportation solutions.

Regulatory Support for Electric Vehicles

Regulatory support for electric vehicles is influencing the golf cart market positively. Various state and local governments in the US are implementing incentives for electric vehicle adoption, including tax credits and rebates. This support extends to electric golf carts, making them more financially accessible to consumers. As a result, the golf cart market is likely to see an increase in electric model sales, as consumers take advantage of these incentives. Furthermore, the push for cleaner transportation options aligns with broader environmental goals, potentially leading to a more robust market for electric golf carts in the coming years.

Growing Demand for Eco-Friendly Transportation

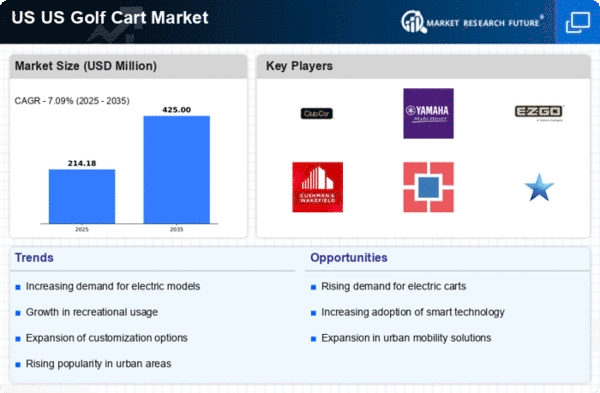

The increasing awareness of environmental issues is driving the golf cart market. Consumers are seeking sustainable alternatives to traditional vehicles, leading to a rise in demand for electric golf carts. In the US, the market for electric golf carts is projected to grow at a CAGR of approximately 6.5% from 2025 to 2030. This shift towards eco-friendly transportation options is not only beneficial for the environment but also aligns with the preferences of younger consumers who prioritize sustainability. As a result, manufacturers in the golf cart market are focusing on developing more energy-efficient models, which could further enhance their market share and appeal to eco-conscious buyers.

Technological Advancements in Golf Cart Design

Technological advancements are playing a crucial role in shaping the golf cart market. Innovations such as improved battery technology, enhanced safety features, and smart connectivity options are attracting consumers. The integration of GPS systems and mobile app compatibility in golf carts is becoming increasingly common, providing users with enhanced navigation and tracking capabilities. As these technologies evolve, they are likely to drive consumer interest and increase sales in the golf cart market. Manufacturers that prioritize research and development in this area may gain a competitive edge, appealing to tech-savvy consumers looking for modern solutions.

Increased Popularity of Golf as a Leisure Activity

The rising popularity of golf as a leisure activity is a key driver for the golf cart market. More individuals are taking up golf, leading to an increase in demand for golf carts for personal use. Recent surveys indicate that participation in golf has grown by approximately 10% in the last few years, particularly among younger demographics. This trend suggests that the golf cart market could see a surge in sales as more players invest in personal carts for convenience and enjoyment. Additionally, the golf cart market may experience growth as golf becomes a favored recreational activity for families and social gatherings.