Increased Focus on Local Sourcing

The freshwater fish market is witnessing a growing trend towards local sourcing, as consumers increasingly prefer products that are produced closer to home. This shift is driven by a desire for fresher products and a commitment to supporting local economies. Market Research Future indicates that locally sourced fish can command a price premium of up to 20% compared to imported alternatives. This trend is encouraging producers to emphasize their local credentials and sustainability practices, thereby enhancing their appeal to environmentally conscious consumers. The freshwater fish market is likely to benefit from this focus on local sourcing, as it aligns with broader consumer preferences for transparency and quality in food production.

Growth of E-commerce and Online Retail

The rise of e-commerce is transforming the freshwater fish market, providing consumers with greater access to a variety of fish products. Online platforms are facilitating direct sales from producers to consumers, which can enhance freshness and reduce costs associated with traditional distribution channels. Market data suggests that online sales of seafood, including freshwater fish, have surged by over 25% in recent years. This shift is particularly appealing to younger consumers who prefer the convenience of online shopping. The freshwater fish market is thus adapting to this trend by enhancing its online presence and marketing strategies, which could lead to increased sales and customer engagement.

Technological Advancements in Aquaculture

Technological innovations in aquaculture are significantly impacting the freshwater fish market. Advances in breeding techniques, feed efficiency, and water quality management are enhancing fish production capabilities. For instance, the implementation of recirculating aquaculture systems (RAS) has allowed for more sustainable and efficient fish farming practices. These systems can reduce water usage by up to 90%, making them an attractive option for producers. Furthermore, the integration of data analytics and IoT technologies is enabling farmers to monitor fish health and optimize feeding schedules, leading to improved yields. As these technologies become more widespread, the freshwater fish market is likely to see increased production efficiency and sustainability, which could attract further investment and consumer interest.

Rising Consumer Demand for Freshwater Fish

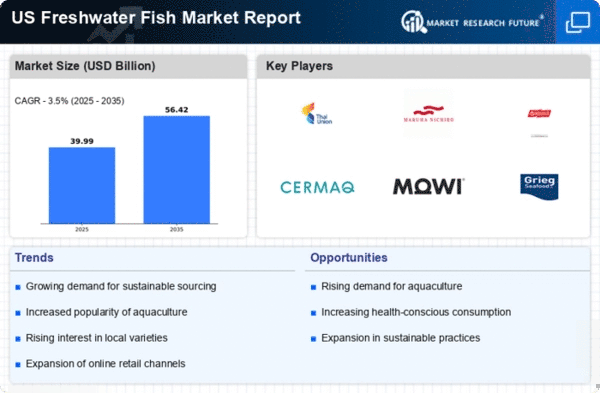

The freshwater fish market is experiencing a notable increase in consumer demand, driven by a growing awareness of the health benefits associated with fish consumption. As consumers become more health-conscious, they are increasingly seeking protein sources that are low in fat and high in omega-3 fatty acids. This trend is reflected in market data, which indicates that the consumption of freshwater fish has risen by approximately 15% over the past five years. Additionally, the shift towards sustainable eating habits has led consumers to prefer freshwater fish over other protein sources, further propelling market growth. The freshwater fish market is thus positioned to benefit from this rising demand, as producers adapt their offerings to meet the evolving preferences of health-oriented consumers.

Regulatory Support for Sustainable Practices

The freshwater fish market is benefiting from increasing regulatory support aimed at promoting sustainable fishing and aquaculture practices. Government initiatives are encouraging the adoption of environmentally friendly methods, which not only help preserve aquatic ecosystems but also enhance the market's reputation among consumers. For example, regulations that incentivize the use of sustainable feed and responsible farming practices are becoming more common. This regulatory environment is fostering a culture of sustainability within the freshwater fish market, which is likely to enhance consumer trust and loyalty. As a result, businesses that align with these regulations may experience a competitive advantage, potentially leading to increased market share and profitability.