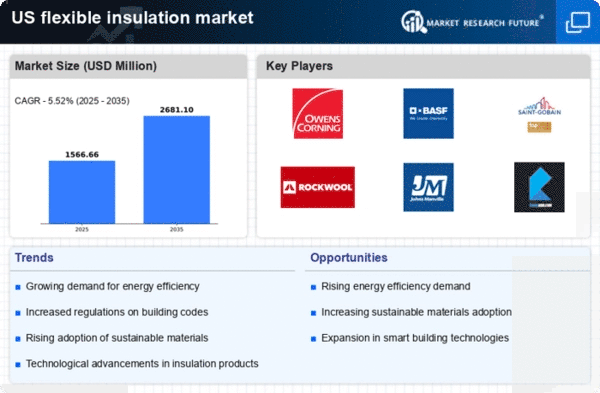

The flexible insulation market is currently characterized by a dynamic competitive landscape, driven by increasing demand for energy-efficient solutions and stringent regulatory frameworks aimed at reducing carbon footprints. Major players such as Owens Corning (US), BASF (DE), and Johns Manville (US) are strategically positioned to leverage innovation and sustainability as core components of their operational focus. Owens Corning (US) emphasizes its commitment to sustainable building materials, while BASF (DE) integrates advanced materials technology to enhance product performance. Collectively, these strategies not only foster competitive differentiation but also contribute to a more sustainable industry framework.Key business tactics within the flexible insulation market include localizing manufacturing and optimizing supply chains to enhance responsiveness to regional demands. The market structure appears moderately fragmented, with several key players exerting influence over specific segments. This fragmentation allows for niche players to thrive, while larger companies capitalize on economies of scale and brand recognition, thereby shaping a competitive environment that is both diverse and robust.

In October Owens Corning (US) announced the launch of a new line of eco-friendly insulation products designed to meet the growing demand for sustainable building materials. This strategic move not only aligns with The flexible insulation market share among environmentally conscious consumers. The introduction of these products is likely to enhance Owens Corning's competitive edge in a market increasingly focused on green solutions.

In September BASF (DE) unveiled a partnership with a leading construction firm to develop innovative insulation solutions that incorporate smart technology. This collaboration is indicative of a broader trend towards integrating digital solutions within the insulation sector, potentially revolutionizing how insulation products are utilized in modern construction. Such strategic alliances may enhance BASF's market presence and drive technological advancements in the industry.

In August Johns Manville (US) expanded its manufacturing capabilities by investing in a new facility dedicated to producing high-performance insulation materials. This expansion reflects a proactive approach to meet rising demand and underscores the company's commitment to innovation and quality. By increasing production capacity, Johns Manville is likely to strengthen its position in the market and respond effectively to evolving customer needs.

As of November current competitive trends in the flexible insulation market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are playing a pivotal role in shaping the landscape, enabling companies to pool resources and expertise to drive innovation. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on technological advancements, sustainable practices, and supply chain reliability, thereby fostering a more resilient and forward-thinking industry.