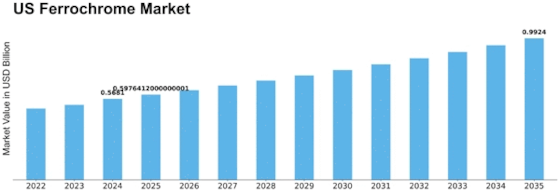

Us Ferrochrome Size

US Ferrochrome Market Growth Projections and Opportunities

The US Ferrochrome Market is influenced by a variety of market factors that collectively contribute to its growth and dynamics. One of the primary drivers is the demand from the stainless steel industry. Ferrochrome, a crucial alloying element in the production of stainless steel, imparts corrosion resistance and strength to the final product. With the continuous growth in construction, infrastructure, and manufacturing sectors, there is an increased demand for stainless steel, consequently driving the demand for ferrochrome in the US market. US Ferrochrome Market Size was valued at USD 0.5 Billion in 2022. The ferrochrome industry is projected to grow from USD 0.54 Billion in 2023 to USD 0.817 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.20%

Moreover, the global economic landscape and trade policies play a significant role in shaping the US Ferrochrome Market. As the United States is both a producer and consumer of ferrochrome, fluctuations in global economic conditions and trade dynamics impact the market. Trade policies and international agreements affect the import and export of ferrochrome, influencing market trends and creating a competitive environment for domestic producers.

Technological advancements and innovations in the production processes contribute to market dynamics. Continuous improvements in smelting technologies and the development of environmentally sustainable production methods influence the efficiency and environmental impact of ferrochrome production. Innovations that enhance the energy efficiency of smelting processes or reduce carbon emissions play a crucial role in shaping the competitiveness of the US ferrochrome industry.

Mining and raw material availability are key factors affecting the ferrochrome market. Chromite ore, the primary raw material for ferrochrome production, is extracted from mines. The accessibility and availability of high-quality chromite ore influence the cost and competitiveness of ferrochrome production. Factors such as geopolitical stability in mining regions, environmental regulations, and the exploration of new mining sites contribute to the overall supply chain dynamics in the US ferrochrome market.

Environmental regulations and sustainability considerations are increasingly influencing the ferrochrome market. The production of ferrochrome involves high energy consumption and emissions. As environmental awareness grows, there is a heightened focus on adopting cleaner and more sustainable production methods in the ferrochrome industry. Producers are investing in technologies that reduce the environmental impact of ferrochrome smelting, including energy-efficient processes and the capture and utilization of by-products.

Market competition and industry consolidation also impact the US Ferrochrome Market. The presence of both domestic and international producers contributes to a competitive environment. Mergers, acquisitions, and strategic partnerships are common as companies seek to enhance their production capacities, secure raw material sources, and gain a competitive edge. This consolidation influences market dynamics by shaping the overall production capacity and market share of key players in the ferrochrome industry.

The automotive industry's shift towards electric vehicles (EVs) has indirect implications for the ferrochrome market. While stainless steel remains a key material in traditional automotive manufacturing, the rise of EVs, which often use alternative materials, could influence the long-term demand for stainless steel and, consequently, ferrochrome. As automotive trends evolve, the ferrochrome market may experience shifts in demand patterns.

Global geopolitical factors, including trade tensions and sanctions, can impact the ferrochrome market. Tariffs, trade agreements, and geopolitical events can affect the flow of ferrochrome between countries, creating uncertainties for market participants. Producers and consumers in the US ferrochrome market closely monitor geopolitical developments that may influence trade dynamics and market conditions.

Leave a Comment