Diverse Product Innovations

Diverse product innovations play a crucial role in shaping the US Rtd Protein Beverages Market. Manufacturers are increasingly focusing on creating a wide array of flavors, formulations, and packaging options to attract a broader consumer base. For instance, the introduction of ready-to-drink protein shakes, smoothies, and fortified waters has expanded the market significantly. In 2025, the market for Rtd protein beverages in the US was valued at approximately 3 billion USD, with projections indicating a compound annual growth rate of around 8% through 2030. This growth is fueled by the introduction of unique ingredients such as collagen, adaptogens, and superfoods, which appeal to health-conscious consumers. The continuous innovation in product offerings not only enhances consumer choice but also drives competition among brands, further propelling the US Rtd Protein Beverages Market.

Health Consciousness Among Consumers

The increasing health consciousness among consumers is a pivotal driver for the US Rtd Protein Beverages Market. As individuals become more aware of the importance of nutrition and fitness, the demand for protein-rich beverages has surged. According to recent surveys, approximately 60% of American adults actively seek out protein-enriched products to support their health goals. This trend is particularly pronounced among millennials and Gen Z, who prioritize functional beverages that align with their lifestyle choices. The US Rtd Protein Beverages Market is responding to this demand by introducing innovative products that cater to various dietary preferences, including plant-based and low-sugar options. This shift not only reflects changing consumer preferences but also indicates a broader movement towards healthier living, which is likely to sustain growth in the market.

Rise of E-commerce and Online Retail

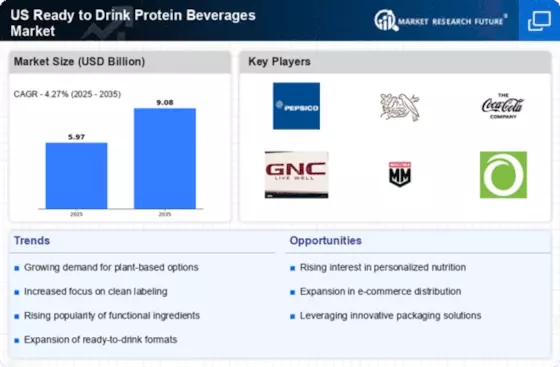

The rise of e-commerce and online retail is transforming the landscape of the US Rtd Protein Beverages Market. With the increasing preference for online shopping, consumers are now able to access a wider range of protein beverages than ever before. In 2025, online sales accounted for nearly 25% of the total market share, reflecting a significant shift in purchasing behavior. This trend is particularly appealing to younger consumers who value convenience and variety. Retailers are capitalizing on this shift by enhancing their online presence and offering subscription services for regular deliveries. The growth of e-commerce not only facilitates easier access to products but also allows brands to engage directly with consumers, fostering brand loyalty and driving sales in the US Rtd Protein Beverages Market.

Sustainability and Ethical Sourcing Trends

Sustainability and ethical sourcing trends are increasingly influencing the US Rtd Protein Beverages Market. Consumers are becoming more discerning about the environmental impact of their purchases, leading to a demand for products that are sustainably sourced and packaged. In 2025, approximately 40% of consumers reported that they prefer brands that prioritize eco-friendly practices. This shift is prompting manufacturers to adopt sustainable sourcing methods and reduce plastic waste through innovative packaging solutions. The US Rtd Protein Beverages Market is responding by launching products that highlight their commitment to sustainability, such as plant-based protein beverages and recyclable packaging. This alignment with consumer values not only enhances brand reputation but also positions companies favorably in a competitive market, potentially driving growth in the sector.

Increased Fitness and Active Lifestyle Participation

Increased participation in fitness and active lifestyles is a notable driver for the US Rtd Protein Beverages Market. As more individuals engage in regular exercise and sports activities, the demand for convenient protein sources has escalated. Recent statistics indicate that over 50% of Americans participate in some form of physical activity, leading to a heightened interest in products that support muscle recovery and overall performance. The US Rtd Protein Beverages Market is witnessing a surge in demand for post-workout protein drinks, which are marketed as essential for recovery. This trend is likely to continue as fitness culture becomes more ingrained in American society, further propelling the growth of the market and encouraging brands to develop targeted products for fitness enthusiasts.