Rising Construction Activities

The drywall and-gypsum-board market experiences a notable boost due to the increasing construction activities across the United States. With a projected growth rate of approximately 4.5% annually, the demand for drywall and gypsum board is expected to rise significantly. This surge is primarily driven by the residential and commercial sectors, where new building projects and renovations are on the rise. The construction industry, which contributes around $1.3 trillion to the US economy, heavily relies on drywall and gypsum board for interior walls and ceilings. As urbanization continues to expand, the drywall and-gypsum-board market is likely to benefit from the heightened need for efficient and cost-effective building materials.

Regulatory Standards and Compliance

The drywall and-gypsum-board market is influenced by stringent regulatory standards and compliance requirements in the construction industry. These regulations often mandate the use of fire-resistant and environmentally friendly materials, which can drive demand for specific types of drywall products. For instance, the adoption of fire-rated drywall is becoming increasingly common in commercial buildings, where safety is paramount. The market is also seeing a shift towards products that meet LEED certification standards, which can enhance energy efficiency and sustainability. As a result, manufacturers are compelled to innovate and adapt their offerings to comply with these regulations, potentially increasing their market share in the drywall and-gypsum-board market.

Increased Focus on Interior Aesthetics

The drywall and-gypsum-board market is significantly impacted by the growing emphasis on interior aesthetics in both residential and commercial spaces. Homeowners and businesses are increasingly investing in high-quality finishes, which often necessitate the use of advanced drywall products. This trend is reflected in the rising demand for specialty boards, such as moisture-resistant and soundproof drywall, which cater to specific aesthetic and functional needs. The market for these specialized products is projected to grow by approximately 6% annually, indicating a shift towards more customized solutions in the drywall and-gypsum-board market. As consumers prioritize design and functionality, manufacturers are likely to respond with innovative product offerings.

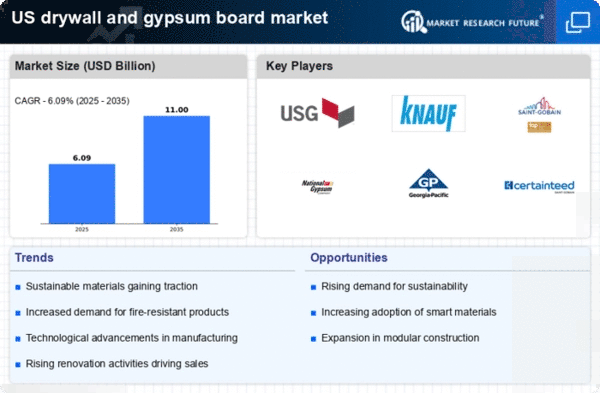

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are reshaping the drywall and-gypsum-board market. Innovations such as automated production lines and advanced material formulations are enhancing efficiency and reducing costs. For instance, the introduction of lightweight drywall products has made installation easier and faster, appealing to both contractors and DIY enthusiasts. Furthermore, the integration of smart technologies in production is expected to improve quality control and reduce waste, aligning with sustainability goals. As these technologies continue to evolve, they may provide a competitive edge to manufacturers, potentially increasing their market share in the drywall and-gypsum-board market.

Growing Demand for Sustainable Building Materials

The drywall and-gypsum-board market is witnessing a growing demand for sustainable building materials, driven by consumer awareness and environmental concerns. As more builders and homeowners seek eco-friendly options, the market for recycled and low-emission drywall products is expanding. This shift is reflected in the increasing availability of products that utilize recycled materials, which can reduce the environmental impact of construction projects. The market for sustainable drywall solutions is projected to grow by around 5% annually, indicating a significant trend towards greener building practices. Manufacturers that prioritize sustainability in their product offerings may find new opportunities for growth in the drywall and-gypsum-board market.