Health and Wellness Trends

The dough conditioners market is also being shaped by the growing health and wellness trends among consumers. There is an increasing awareness regarding the nutritional content of food products, leading to a demand for healthier alternatives. As a result, manufacturers are reformulating their products to include natural and organic dough conditioners that align with these health-conscious preferences. Reports indicate that the organic food market is expected to grow by approximately 10% annually, which could positively impact the dough conditioners market as producers seek to incorporate cleaner ingredients. This shift towards health-oriented products may drive innovation in the development of new dough conditioners that meet consumer expectations for both taste and nutrition.

Regulatory Support for Food Safety

Regulatory frameworks aimed at enhancing food safety are influencing the dough conditioners market. In the US, agencies such as the FDA are implementing stricter guidelines regarding food additives and ingredients. This regulatory environment encourages manufacturers to adopt high-quality dough conditioners that comply with safety standards. As a result, there is a growing emphasis on transparency and traceability in ingredient sourcing. The market for food safety compliance solutions is expected to grow by approximately 8% annually, which may drive demand for dough conditioners that meet these regulatory requirements. This focus on safety and quality assurance is likely to foster consumer trust and, in turn, support the growth of the dough conditioners market.

Technological Advancements in Baking

Technological innovations in the baking industry are significantly influencing the dough conditioners market. Advanced processing techniques and the introduction of automated baking systems have improved the efficiency and consistency of dough production. For instance, the use of enzyme-based dough conditioners has been shown to enhance dough elasticity and fermentation, leading to superior product quality. The market for these technologies is expected to expand, with estimates suggesting a growth rate of around 5% annually. As bakers increasingly adopt these innovations, the demand for specialized dough conditioners that can optimize performance in various baking applications is likely to rise, further propelling the market forward.

Increasing Demand for Convenience Foods

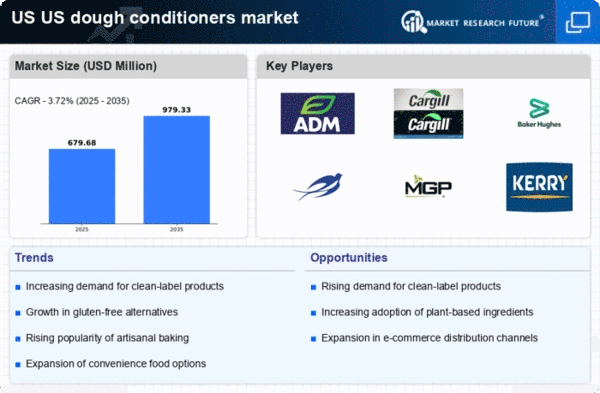

The dough conditioners market is experiencing a notable surge in demand for convenience foods, driven by changing consumer lifestyles. As more individuals seek quick meal solutions, the need for ready-to-use dough products has escalated. This trend is particularly evident in urban areas where busy schedules limit cooking time. According to industry reports, the convenience food sector is projected to grow at a CAGR of approximately 4.5% through 2027. Consequently, manufacturers are increasingly incorporating dough conditioners to enhance the texture and shelf-life of their products, thereby catering to the evolving preferences of consumers. This shift towards convenience is likely to bolster the dough conditioners market, as producers strive to meet the growing expectations for quality and ease of use.

Expansion of Artisan and Specialty Bakeries

The rise of artisan and specialty bakeries is contributing to the growth of the dough conditioners market. As consumers increasingly seek unique and high-quality baked goods, these establishments are gaining popularity. Artisan bakers often utilize dough conditioners to achieve specific textures and flavors that differentiate their products in a competitive market. The specialty bakery segment is projected to grow at a CAGR of around 6% over the next few years, indicating a robust demand for innovative baking solutions. This trend suggests that the dough conditioners market will likely benefit from the increasing focus on quality and craftsmanship in baking, as more bakers turn to these products to enhance their offerings.