Rising Data Security Concerns

Data security concerns are increasingly influencing the US Digital Storage Devices Market. With the growing incidence of cyber threats and data breaches, consumers and businesses are prioritizing secure storage solutions. In 2025, approximately 70% of organizations reported investing in enhanced data protection measures, including encrypted storage devices. This trend is likely to drive demand for storage solutions that offer robust security features, such as hardware encryption and biometric access controls. Furthermore, regulatory frameworks, such as the California Consumer Privacy Act (CCPA), are compelling companies to adopt stringent data protection practices. As a result, manufacturers are focusing on developing storage devices that not only provide ample capacity but also ensure the integrity and confidentiality of stored data. This heightened emphasis on security is expected to shape product offerings and influence purchasing decisions in the market.

Technological Advancements in Storage Devices

Technological advancements are playing a pivotal role in shaping the US Digital Storage Devices Market. Innovations such as NVMe (Non-Volatile Memory Express) and 3D NAND technology have significantly enhanced the performance and efficiency of storage devices. These advancements enable faster data transfer rates and improved durability, which are crucial for both consumer and enterprise applications. In 2025, the SSD segment alone accounted for over 60% of the total storage market, underscoring the shift towards high-performance storage solutions. Additionally, the integration of artificial intelligence in storage management systems is streamlining data organization and retrieval processes. As technology continues to evolve, it is anticipated that the market will witness the introduction of even more sophisticated storage solutions, catering to the diverse needs of users across various sectors.

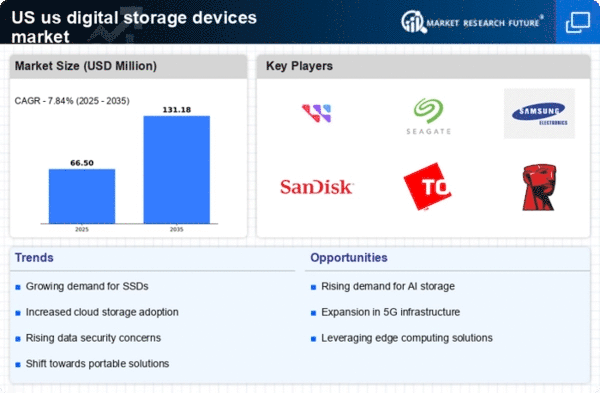

Growing Demand for High-Capacity Storage Solutions

The US Digital Storage Devices Market is experiencing a notable surge in demand for high-capacity storage solutions. As data generation continues to escalate, driven by the proliferation of digital content and the Internet of Things (IoT), consumers and businesses alike are seeking storage devices that can accommodate vast amounts of information. In 2025, the market for external hard drives and solid-state drives (SSDs) reached approximately 15 billion USD, reflecting a robust growth trajectory. This trend is likely to persist as organizations increasingly rely on data analytics and cloud computing, necessitating efficient storage solutions. Furthermore, the rise of 4K and 8K video content, along with high-resolution images, further propels the need for larger storage capacities. Consequently, manufacturers are innovating to provide advanced storage technologies that meet these evolving demands.

Increased Use of Digital Content in Various Sectors

The proliferation of digital content across various sectors is significantly impacting the US Digital Storage Devices Market. Industries such as entertainment, healthcare, and education are increasingly relying on digital formats for content delivery and data management. For instance, the entertainment sector has seen a dramatic rise in streaming services, necessitating substantial storage capabilities for both content providers and consumers. In 2025, the demand for storage devices in the media and entertainment industry alone was projected to exceed 10 billion USD. Additionally, the healthcare sector's shift towards electronic health records (EHR) and telemedicine is further driving the need for reliable storage solutions. As digital content continues to expand, the market is likely to witness sustained growth, with manufacturers adapting their offerings to meet the specific requirements of diverse industries.

Shift Towards Portable and Mobile Storage Solutions

The shift towards portable and mobile storage solutions is reshaping the US Digital Storage Devices Market. As remote work and mobile computing become increasingly prevalent, consumers are seeking storage devices that offer convenience and portability. In 2025, the market for USB flash drives and portable SSDs experienced a growth rate of over 15%, reflecting the rising preference for on-the-go storage options. This trend is further fueled by the need for seamless data transfer between devices and the increasing use of mobile applications. Manufacturers are responding by developing compact and lightweight storage solutions that do not compromise on performance. As the demand for mobile storage continues to rise, it is anticipated that the market will evolve to include innovative products that cater to the dynamic needs of users in a mobile-centric world.