Integration of Advanced Audio Technologies

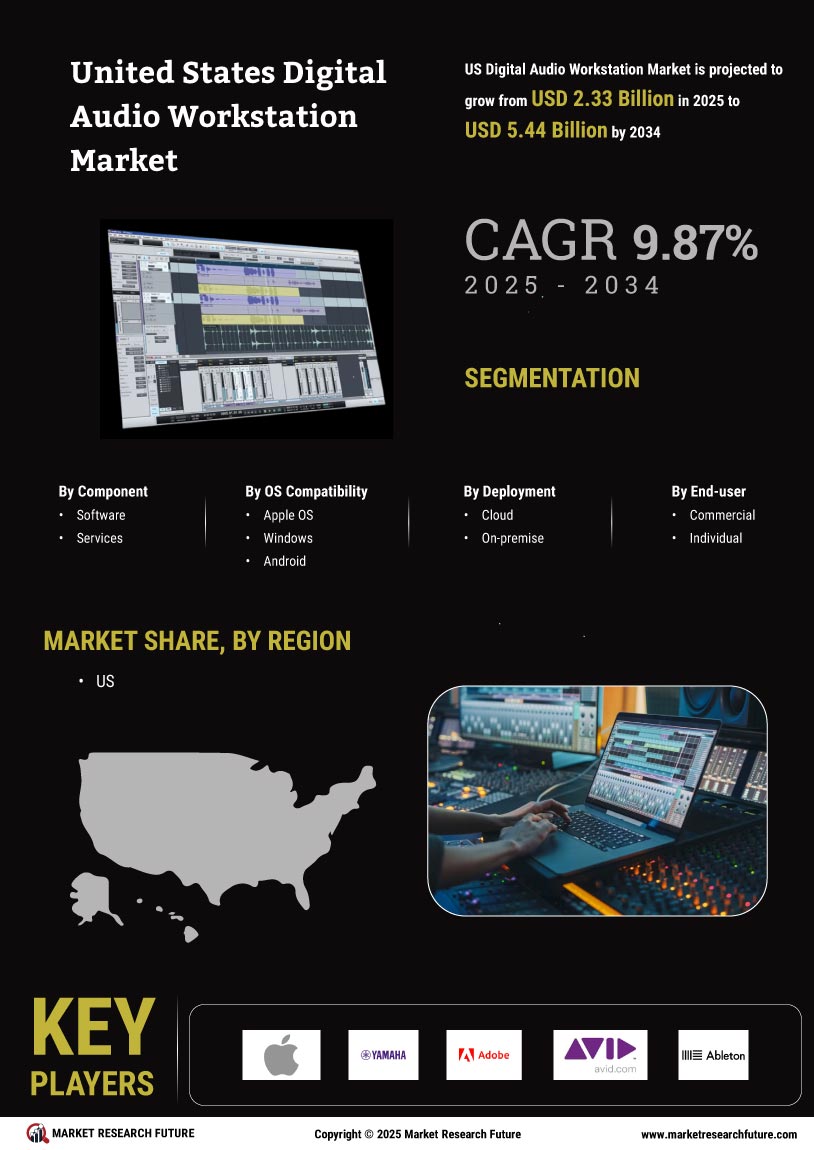

The US Digital Audio Workstations Market is witnessing a transformative phase with the integration of advanced audio technologies. Innovations such as spatial audio, immersive sound, and enhanced audio processing capabilities are becoming increasingly prevalent in digital audio workstations. This technological evolution is not only appealing to professional sound engineers but also to hobbyists and content creators who seek high-quality audio production. Market data indicates that the adoption of advanced audio technologies has grown by approximately 25% in the last year alone. As these technologies become more accessible, they are likely to drive further growth in the market, as users demand more sophisticated tools to enhance their audio projects. This trend suggests a promising future for the US Digital Audio Workstations Market as it adapts to the evolving landscape of audio production.

Expansion of Online Education and Tutorials

The US Digital Audio Workstations Market is significantly influenced by the expansion of online education and tutorials. With the rise of platforms offering music production courses, more individuals are gaining access to learning resources that were previously unavailable. This trend has led to an increase in the number of users seeking digital audio workstations to practice their skills. Data suggests that online music production courses have seen enrollment growth of approximately 40% in the past two years. Consequently, this influx of new users is driving demand for intuitive and feature-rich digital audio workstations, as learners seek tools that facilitate their educational journey. The market is likely to continue benefiting from this trend as educational institutions and independent educators increasingly incorporate digital audio workstations into their curricula.

Increased Collaboration in Music Production

The US Digital Audio Workstations Market is benefiting from the increased collaboration in music production. With the rise of remote working and digital collaboration tools, musicians and producers are now able to work together from different locations seamlessly. This trend has led to a growing demand for digital audio workstations that support collaborative features, such as cloud-based project sharing and real-time editing. Market analysis shows that collaborative features in digital audio workstations have seen a 35% increase in user adoption over the past year. As more artists embrace this collaborative approach, the market is likely to see continued growth, as developers enhance their offerings to meet the needs of a more interconnected music production environment.

Rising Demand for Music Production Software

The US Digital Audio Workstations Market is experiencing a notable surge in demand for music production software. This trend is largely driven by the increasing number of independent artists and home studios, which have proliferated due to advancements in technology. According to recent data, the number of home studios in the US has increased by over 30% in the last five years, indicating a shift towards more accessible music production. As a result, software developers are focusing on creating user-friendly interfaces and affordable solutions to cater to this growing demographic. This rising demand not only enhances the market's growth potential but also encourages innovation within the industry, as companies strive to meet the diverse needs of both amateur and professional musicians.

Growth of Content Creation for Digital Platforms

The US Digital Audio Workstations Market is significantly impacted by the growth of content creation for digital platforms. As social media and streaming services continue to dominate the entertainment landscape, there is an increasing need for high-quality audio content. This demand is driving both amateur and professional creators to invest in digital audio workstations that can deliver superior sound quality. Recent statistics indicate that the number of content creators in the US has doubled in the past three years, further fueling the market's expansion. As creators seek to differentiate their content, the demand for versatile and powerful digital audio workstations is likely to rise, presenting opportunities for software developers to innovate and cater to this burgeoning audience.