Growing Awareness of Oral Health

The dental anesthesia market benefits from the growing awareness of oral health among the general population. Educational campaigns and initiatives by dental associations have led to increased recognition of the importance of regular dental check-ups and treatments. As individuals become more proactive about their oral health, the demand for dental services, including anesthesia, is expected to rise. This heightened awareness is particularly evident among younger demographics, who prioritize preventive care and are more likely to seek dental treatments that require anesthesia. Consequently, the dental anesthesia market is likely to experience growth as more patients seek out dental services that ensure their oral health is maintained effectively.

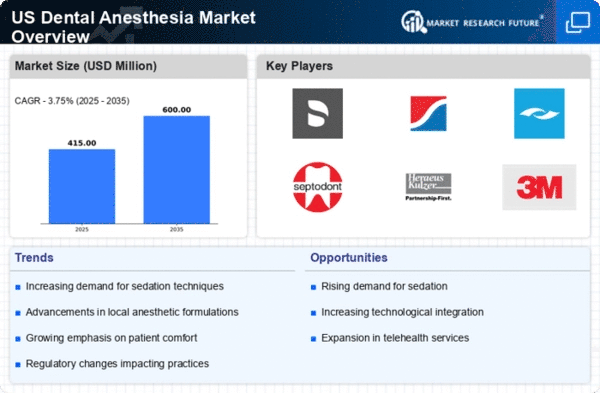

Rising Number of Dental Procedures

The dental anesthesia market is significantly influenced by the increasing number of dental procedures performed annually. With the American Dental Association reporting a steady rise in dental visits, the demand for anesthesia services is expected to grow correspondingly. In 2025, it is estimated that over 200 million dental procedures will be conducted in the US, necessitating effective anesthesia solutions. This trend is further supported by the aging population, which often requires more complex dental interventions. As the volume of procedures increases, dental practitioners are likely to invest in advanced anesthesia techniques to ensure patient comfort and safety. Consequently, the dental anesthesia market is expected to grow, driven by the need to accommodate a higher patient load and the complexity of dental treatments.

Regulatory Support for Anesthesia Practices

Regulatory support plays a pivotal role in shaping the dental anesthesia market. Recent updates to guidelines and regulations governing anesthesia practices have fostered a safer environment for both practitioners and patients. The American Dental Association and other regulatory bodies have established protocols that enhance the training and certification of dental professionals in anesthesia administration. This regulatory framework not only ensures patient safety but also encourages the adoption of advanced anesthesia techniques. As regulations continue to evolve, the dental anesthesia market is likely to benefit from increased confidence among practitioners and patients alike, leading to a broader acceptance of innovative anesthesia solutions.

Increasing Demand for Pain Management Solutions

The dental anesthesia market experiences a notable surge in demand for effective pain management solutions. Patients increasingly seek procedures that minimize discomfort, leading to a rise in the adoption of advanced anesthetic techniques. According to recent data, approximately 70% of patients express a preference for minimally invasive dental procedures that utilize effective anesthesia. This trend is driven by heightened awareness of pain management options and the desire for improved patient experiences. As dental professionals prioritize patient comfort, the market for dental anesthesia is likely to expand, with innovations in local anesthetics and sedation techniques playing a crucial role. The growing emphasis on pain-free dentistry is expected to propel the dental anesthesia market forward, as practitioners adopt new technologies to meet patient expectations.

Technological Innovations in Anesthesia Delivery

Technological innovations are reshaping the dental anesthesia market, enhancing the efficacy and safety of anesthesia delivery. The introduction of computer-controlled local anesthetic delivery systems has revolutionized the way anesthesia is administered, allowing for more precise and controlled dosages. These advancements not only improve patient comfort but also reduce the risk of complications associated with traditional methods. Furthermore, the integration of digital technologies in dental practices facilitates better monitoring of patient responses during procedures. As dental professionals increasingly adopt these innovative solutions, the market for dental anesthesia is likely to expand, reflecting a shift towards more sophisticated and patient-friendly anesthesia options.