Expansion of 5G Technology

The rollout of 5G technology is poised to have a transformative impact on the data centre market, as it enables faster data transmission and improved connectivity. With the increasing adoption of IoT devices and smart technologies, the demand for low-latency data processing is becoming paramount. In 2025, it is expected that the integration of 5G networks will lead to a 30% increase in data traffic handled by data centres. This surge in demand necessitates the expansion of data centre infrastructure to support the enhanced connectivity and processing capabilities required by 5G applications. Consequently, data centre operators are likely to invest in upgrading their facilities and adopting innovative technologies to ensure they can meet the evolving needs of businesses and consumers in a 5G-enabled environment.

Increased Focus on Data Security

In an era where data breaches and cyber threats are prevalent, the data centre market is witnessing an intensified focus on data security measures. Organizations are investing heavily in advanced security protocols to protect sensitive information, which is becoming a critical component of their operational strategies. In 2025, it is estimated that spending on data security solutions within the data centre market will rise by 25%, reflecting the urgent need for robust protection mechanisms. This trend is likely to drive the adoption of innovative technologies such as artificial intelligence and machine learning, which can enhance threat detection and response capabilities. Consequently, the data centre market is evolving to not only provide storage and processing power but also to serve as a secure environment for data management, thereby reinforcing trust among clients and stakeholders.

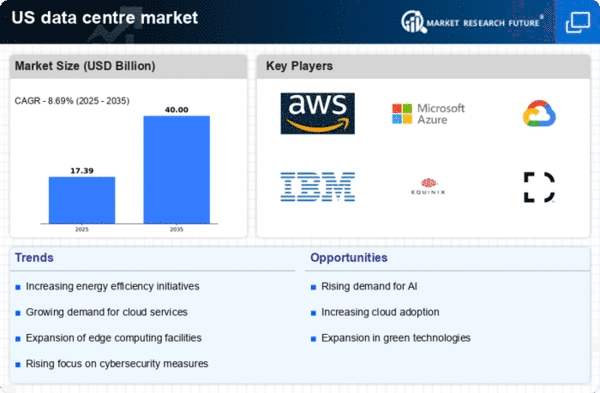

Rising Demand for Cloud Services

The data centre market experiences a notable surge in demand for cloud services, driven by businesses increasingly migrating their operations to cloud-based platforms. This shift is indicative of a broader trend where organizations seek to enhance operational efficiency and scalability. In 2025, the cloud services sector is projected to account for approximately 30% of the total data centre market revenue in the US, reflecting a significant growth trajectory. As enterprises prioritize flexibility and cost-effectiveness, the data centre market is likely to adapt by expanding its infrastructure to accommodate the growing volume of data and applications hosted in the cloud. This evolution not only supports the operational needs of businesses but also fosters innovation in service delivery, thereby reinforcing the importance of data centres in the digital economy.

Regulatory Compliance Requirements

The data centre market is increasingly influenced by stringent regulatory compliance requirements that govern data management and privacy. In the US, regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose significant obligations on organizations regarding data handling practices. As a result, data centres must adapt their operations to ensure compliance, which often entails substantial investments in infrastructure and technology. In 2025, it is projected that compliance-related expenditures will constitute around 15% of the total operational costs for data centres. This focus on regulatory adherence not only enhances the credibility of data centre providers but also positions them as trusted partners for businesses navigating complex legal landscapes. Thus, the data centre market is evolving to meet these compliance challenges while maintaining operational efficiency.

Growth of Artificial Intelligence Applications

The proliferation of artificial intelligence (AI) applications is reshaping the data centre market, as organizations increasingly leverage AI to enhance decision-making and operational efficiency. In 2025, it is anticipated that AI-driven workloads will account for nearly 20% of the total data processed within data centres. This shift necessitates the development of specialized infrastructure capable of supporting high-performance computing and data analytics. As a result, data centre providers are likely to invest in advanced hardware and software solutions to accommodate the unique demands of AI applications. This trend not only drives innovation within the data centre market but also fosters collaboration between technology providers and data centre operators, ultimately leading to more efficient and effective data management solutions.