Rising Data Traffic

The data center-interconnect market is experiencing a surge in data traffic, driven by the proliferation of cloud computing, IoT devices, and big data analytics. As organizations increasingly rely on data-intensive applications, the demand for robust interconnect solutions has escalated. In the US, data traffic is projected to grow at a CAGR of 25% through 2025, necessitating enhanced connectivity solutions. This trend compels data centers to invest in high-capacity interconnect technologies to manage the influx of data efficiently. Consequently, the rising data traffic is a pivotal driver for the data center-interconnect market, as it pushes for innovations in bandwidth and latency reduction, ensuring seamless data flow across interconnected facilities.

Emergence of 5G Technology

The rollout of 5G technology is poised to have a transformative impact on the data center-interconnect market. With its promise of ultra-low latency and high-speed connectivity, 5G is expected to drive new applications and services that require robust interconnect solutions. In the US, the 5G market is projected to exceed $300 billion by 2025, creating a substantial demand for data center interconnect capabilities that can support the increased data flow. This technological advancement compels data centers to enhance their interconnect infrastructure, ensuring they can meet the demands of 5G-enabled applications. As a result, the emergence of 5G technology serves as a critical driver for the data center-interconnect market, fostering innovation and investment in interconnect solutions.

Expansion of Cloud Services

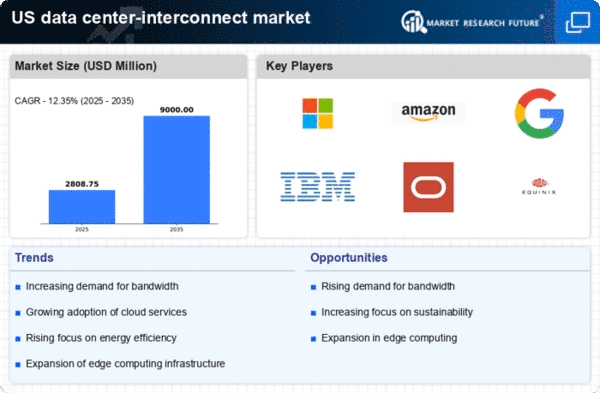

The rapid expansion of cloud services is significantly influencing the data center-interconnect market. As businesses migrate to cloud-based solutions, the need for reliable and high-speed interconnectivity between data centers becomes paramount. In the US, the cloud services market is expected to reach $500 billion by 2025, highlighting the increasing reliance on cloud infrastructure. This growth necessitates advanced interconnect solutions that can support the dynamic demands of cloud applications. The data center-interconnect market is thus driven by the need for scalable and flexible interconnect options that can accommodate the evolving landscape of cloud services, ensuring optimal performance and connectivity.

Increased Focus on Security

As cyber threats continue to evolve, the data center-interconnect market is witnessing an increased focus on security measures. Organizations are prioritizing secure data transmission and interconnectivity to protect sensitive information. In the US, cybersecurity spending is projected to reach $200 billion by 2025, reflecting the growing importance of safeguarding data across interconnected systems. This heightened emphasis on security drives the demand for interconnect solutions that incorporate advanced encryption and security protocols. Consequently, the data center-interconnect market is influenced by the necessity for secure interconnect options that can mitigate risks and ensure compliance with regulatory standards, thereby enhancing overall data protection.

Adoption of Hybrid IT Environments

The shift towards hybrid IT environments is reshaping the data center-interconnect market. Organizations are increasingly adopting a mix of on-premises and cloud-based solutions to optimize their IT infrastructure. This trend necessitates seamless interconnectivity between various environments, driving demand for advanced interconnect solutions. In the US, the hybrid cloud market is expected to grow to $100 billion by 2025, indicating a significant shift in IT strategies. The data center-interconnect market is thus propelled by the need for solutions that facilitate efficient data transfer and management across hybrid environments, ensuring organizations can leverage the benefits of both on-premises and cloud resources effectively.