Increased Focus on Women's Health

The heightened focus on women's health issues is a significant driver for the contraceptive drugs market. As societal attitudes shift towards prioritizing women's health, there is a growing demand for products that cater specifically to their needs. This trend is reflected in the increasing investment in women's health research, which has seen funding rise by over 30% in recent years. Additionally, healthcare providers are more frequently discussing contraceptive options with patients, leading to higher prescription rates. This focus on women's health not only supports the contraceptive drugs market but also encourages the development of innovative products tailored to women's unique health requirements.

Rising Awareness of Family Planning

The increasing awareness surrounding family planning is a pivotal driver for the contraceptive drugs market. Educational initiatives and public health campaigns have significantly contributed to a better understanding of reproductive health. As individuals become more informed about their options, the demand for contraceptive drugs is likely to rise. In the US, surveys indicate that approximately 62% of women aged 15-49 are currently using some form of contraception, highlighting a growing acceptance of these products. This trend suggests that as awareness continues to expand, the contraceptive drugs market will experience sustained growth, driven by a more informed consumer base seeking effective family planning solutions.

Policy Changes and Insurance Coverage

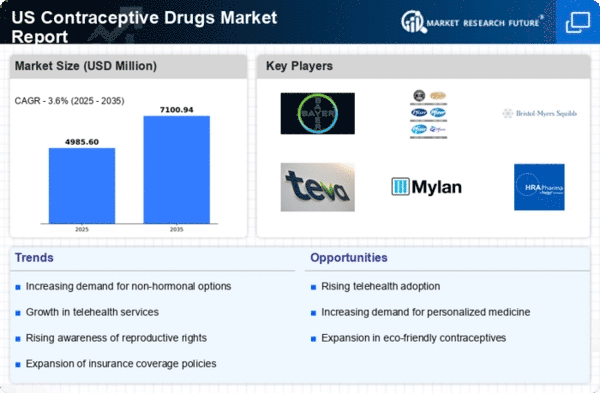

Policy changes and insurance coverage are critical factors impacting the contraceptive drugs market. Recent legislative efforts aimed at improving access to contraceptive methods have resulted in expanded insurance coverage for various contraceptive options. In the US, the Affordable Care Act mandates that most health plans cover contraceptive services without cost-sharing, which has led to a notable increase in contraceptive use. This policy shift not only enhances accessibility but also encourages individuals to seek out contraceptive drugs, thereby driving market growth. As policies continue to evolve, the contraceptive drugs market is likely to benefit from increased utilization and a broader consumer base.

Changing Demographics and Lifestyle Choices

Changing demographics and evolving lifestyle choices are influencing the contraceptive drugs market. As the US population becomes more diverse and urbanized, the preferences and needs regarding contraception are also shifting. Younger generations are increasingly delaying marriage and childbearing, leading to a higher demand for contraceptive options. Data suggests that nearly 50% of women aged 18-29 are using some form of contraception, reflecting a trend towards proactive family planning. This demographic shift indicates that the contraceptive drugs market must adapt to cater to the preferences of a younger, more diverse population, potentially driving innovation and product development.

Technological Advancements in Drug Development

Technological advancements in drug development are transforming the contraceptive drugs market. Innovations in pharmaceutical research and development have led to the creation of more effective and user-friendly contraceptive options. For instance, the introduction of long-acting reversible contraceptives (LARCs) has gained traction, with usage rates increasing by 25% over the past decade in the US. These advancements not only enhance efficacy but also improve patient compliance, as users prefer methods that require less frequent intervention. Consequently, the contraceptive drugs market is poised for growth as new technologies continue to emerge, offering diverse options to meet varying consumer needs.