Consumer Awareness and Education

Consumer awareness and education are pivotal in driving the connected iot-devices market. As individuals become more informed about the benefits and functionalities of IoT devices, their willingness to adopt these technologies increases. Educational campaigns and marketing efforts by manufacturers are helping to demystify IoT solutions, highlighting their potential to enhance daily life through improved convenience, security, and energy management. Surveys indicate that nearly 70% of consumers express interest in smart devices, yet many remain unaware of their capabilities. This gap presents an opportunity for companies to engage in targeted outreach, ultimately fostering a more informed consumer base and stimulating growth within the connected iot-devices market.

Government Initiatives and Regulations

Government initiatives and regulations play a crucial role in shaping the connected iot-devices market. In the US, various policies are being implemented to promote the adoption of IoT technologies across sectors. For example, the Federal Communications Commission (FCC) has introduced frameworks to enhance broadband access, which is essential for the effective functioning of connected devices. Additionally, funding programs aimed at smart city projects are encouraging local governments to invest in IoT infrastructure. These initiatives are expected to create a favorable environment for the growth of the connected iot-devices market, as they facilitate the deployment of innovative solutions that improve public services and enhance quality of life.

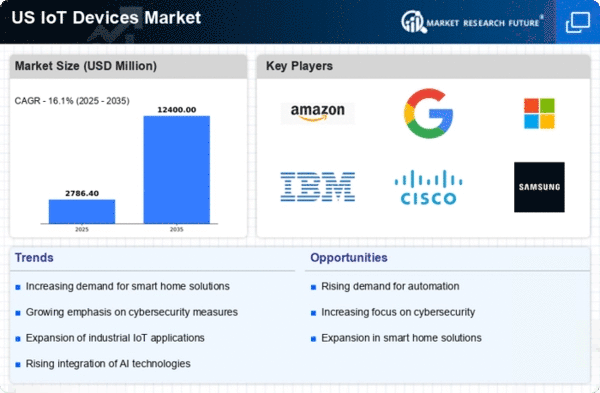

Rising Demand for Smart Home Solutions

The connected iot-devices market is experiencing a surge in demand for smart home solutions, driven by consumer preferences for convenience and automation. As households increasingly adopt smart devices, the market is projected to grow significantly. According to recent estimates, the smart home segment alone is expected to reach a valuation of over $100 billion by 2025. This trend is fueled by advancements in technology, enabling seamless integration of devices such as smart thermostats, security cameras, and lighting systems. The growing awareness of energy efficiency and cost savings further propels this demand, as consumers seek to optimize their home environments. Consequently, manufacturers are focusing on developing innovative products that enhance user experience, thereby contributing to the overall growth of the connected iot-devices market.

Expansion of Industrial IoT Applications

The connected iot-devices market is witnessing a notable expansion in industrial IoT applications, as businesses increasingly recognize the benefits of automation and data analytics. Industries such as manufacturing, logistics, and healthcare are adopting connected devices to enhance operational efficiency and reduce costs. For instance, predictive maintenance solutions are being implemented to minimize downtime and extend equipment lifespan. The market for industrial IoT is projected to grow at a CAGR of approximately 25% over the next few years, indicating a robust shift towards digital transformation. This trend not only improves productivity but also fosters innovation in product development and service delivery, thereby driving the connected iot-devices market forward.

Advancements in Connectivity Technologies

Advancements in connectivity technologies are significantly influencing the connected iot-devices market. The rollout of 5G networks is expected to revolutionize the way devices communicate, offering faster speeds and lower latency. This enhanced connectivity enables a greater number of devices to operate simultaneously, which is particularly beneficial for applications requiring real-time data processing. Furthermore, the integration of edge computing is allowing for more efficient data management, reducing the burden on cloud infrastructure. As these technologies continue to evolve, they are likely to drive innovation and expand the capabilities of connected devices, thereby propelling the growth of the connected iot-devices market.