E-commerce Growth

The coffee pods-and-capsules market is witnessing a notable transformation due to the rapid growth of e-commerce platforms. With the increasing reliance on online shopping, consumers are now able to access a wider range of coffee pod options from the comfort of their homes. This shift has been accelerated by the convenience of home delivery services, which have become a preferred choice for many. Recent statistics reveal that online sales of coffee products have surged by approximately 40% in the last year, highlighting the significant impact of e-commerce on consumer purchasing behavior. As this trend continues, it is likely to bolster the coffee pods-and-capsules market.

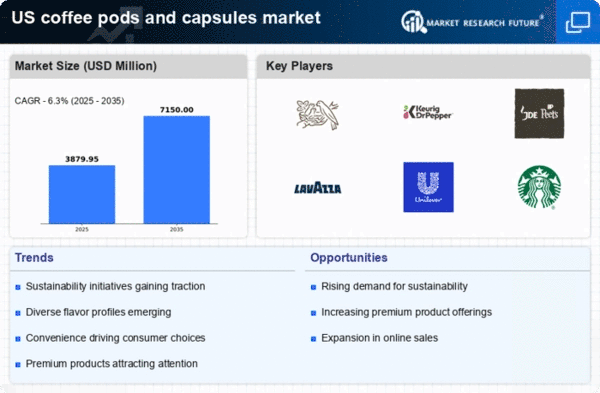

Sustainability Concerns

The coffee pods-and-capsules market is increasingly affected by growing sustainability concerns among consumers. As awareness of environmental issues rises, many consumers are seeking eco-friendly alternatives to traditional coffee pods. This has led to a demand for recyclable and biodegradable options, prompting manufacturers to innovate and adapt their product offerings. Recent studies indicate that nearly 50% of consumers are willing to pay more for sustainable products, which suggests a shift in purchasing behavior. This focus on sustainability is expected to play a crucial role in shaping the future of the coffee pods-and-capsules market, as companies strive to meet consumer expectations.

Health and Wellness Trends

The coffee pods-and-capsules market is increasingly shaped by the rising health and wellness trends among consumers. There is a growing awareness regarding the health benefits associated with coffee consumption, such as its potential antioxidant properties. Additionally, the demand for organic and specialty coffee options is on the rise, with consumers willing to pay a premium for products that align with their health-conscious lifestyles. Recent data suggests that organic coffee sales have increased by over 25% in the past year, indicating a shift towards healthier choices. This trend is expected to further influence the coffee pods-and-capsules market as consumers seek healthier alternatives.

Diverse Consumer Preferences

The coffee pods-and-capsules market is significantly influenced by the diverse preferences of consumers. As the market evolves, there is a noticeable shift towards a variety of flavors and blends, catering to different taste profiles. Recent surveys indicate that nearly 70% of consumers express interest in trying new flavors, which has prompted manufacturers to innovate and expand their product lines. This diversification not only attracts new customers but also retains existing ones, as they seek unique and personalized coffee experiences. Consequently, the emphasis on flavor variety is likely to drive the growth of the coffee pods-and-capsules market.

Convenience and Time Efficiency

The coffee pods-and-capsules market is experiencing a surge in demand driven by the increasing preference for convenience and time efficiency among consumers. Busy lifestyles have led to a growing number of individuals seeking quick and easy coffee solutions. The ability to brew a fresh cup of coffee in under a minute using coffee pods appeals to those with limited time. According to recent data, approximately 60% of coffee drinkers in the US prefer single-serve options due to their speed and simplicity. This trend is likely to continue, as more consumers prioritize convenience in their daily routines, thereby propelling the growth of the coffee pods-and-capsules market.