Increasing Focus on Patient Safety

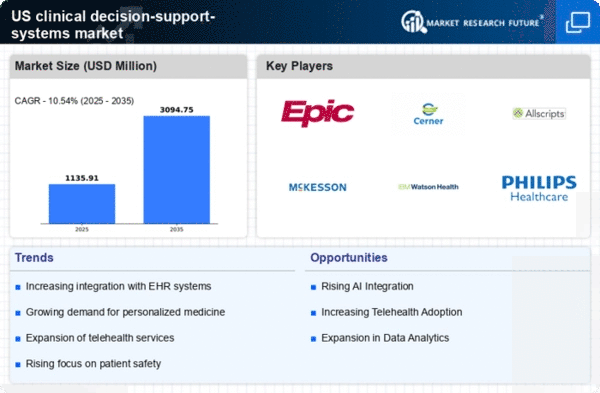

The clinical decision-support-systems market is witnessing a heightened focus on patient safety. This focus is becoming a critical driver for adoption. Healthcare organizations are increasingly prioritizing the reduction of medical errors and adverse events, leading to a demand for systems that can provide real-time alerts and recommendations. Clinical decision-support systems are designed to assist clinicians in making safer decisions by flagging potential issues such as drug interactions or allergies. According to the Agency for Healthcare Research and Quality, medical errors cost the US healthcare system approximately $19 billion annually. This alarming statistic underscores the necessity for effective clinical decision-support systems that can enhance patient safety and improve overall healthcare quality.

Integration of Telehealth Services

The clinical decision-support-systems market is positively impacted by the integration of telehealth services into healthcare delivery. As telehealth becomes more prevalent, there is a growing need for clinical decision-support systems that can operate effectively within virtual care environments. These systems can assist healthcare providers in making informed decisions during remote consultations, ensuring that patients receive appropriate care regardless of their location. The American Telemedicine Association reports that telehealth usage has increased by over 50% in recent years, highlighting the necessity for robust clinical decision-support tools that can enhance the quality of care delivered through telehealth platforms. This integration is likely to drive further growth in the clinical decision-support-systems market.

Growing Emphasis on Value-Based Care

The clinical decision-support-systems market is being shaped by the growing emphasis on value-based care models. As healthcare shifts from volume-based to value-based reimbursement, providers are increasingly seeking tools that can help them deliver high-quality care while managing costs. Clinical decision-support systems play a pivotal role in this transition by providing evidence-based recommendations that align with best practices. This approach not only improves patient outcomes but also enhances operational efficiency. The Centers for Medicare & Medicaid Services (CMS) has indicated that value-based care initiatives could account for over 50% of all Medicare payments by 2025. This shift is likely to drive the adoption of clinical decision-support systems as providers aim to meet the demands of value-based care.

Rising Demand for Personalized Medicine

The clinical decision-support-systems market is experiencing a notable surge in demand for personalized medicine. This trend is driven by the increasing recognition of the need for tailored treatment plans that cater to individual patient characteristics. As healthcare providers strive to enhance patient outcomes, the integration of clinical decision-support systems becomes essential. These systems facilitate the analysis of vast amounts of patient data, enabling clinicians to make informed decisions based on specific patient profiles. According to recent estimates, the market for personalized medicine is projected to reach $350 billion by 2025, indicating a robust growth trajectory. This shift towards personalized approaches is likely to propel the adoption of clinical decision-support systems, as they play a crucial role in optimizing treatment strategies and improving patient care.

Advancements in Health Information Technology

The clinical decision-support-systems market is significantly influenced by advancements in health information technology (HIT). The proliferation of electronic health records (EHRs) and other digital health solutions has created an environment conducive to the implementation of clinical decision-support systems. These technologies enhance data accessibility and interoperability, allowing healthcare providers to leverage real-time information for better clinical decision-making. As of 2025, it is estimated that over 90% of hospitals in the US have adopted EHR systems, which serve as a foundation for integrating clinical decision-support tools. This widespread adoption of HIT is likely to drive the growth of the clinical decision-support-systems market, as providers seek to enhance care quality and streamline workflows through data-driven insights.