Rising Fuel Costs

Fluctuating fuel prices significantly impact the climate control-system-commercial-vehicle market, as operators seek to optimize fuel efficiency. With fuel costs representing a substantial portion of operational expenses, there is a growing demand for climate control systems that enhance vehicle efficiency and reduce fuel consumption. Advanced climate control technologies, such as automatic temperature regulation and energy-efficient HVAC systems, are increasingly being adopted to mitigate these costs. According to recent data, improvements in climate control systems can lead to fuel savings of up to 15%, making them an attractive investment for fleet operators. Thus, rising fuel costs serve as a strong impetus for innovation within the climate control-system-commercial-vehicle market.

Consumer Demand for Comfort

The climate control-system-commercial-vehicle market is driven by the increasing demand for enhanced comfort and convenience in commercial vehicles. As competition intensifies among manufacturers, the expectation for superior climate control features has risen. Fleet operators are increasingly prioritizing driver comfort, recognizing that it can lead to improved productivity and reduced turnover rates. Features such as advanced air filtration, customizable temperature settings, and noise reduction technologies are becoming standard in new vehicle models. This shift towards prioritizing comfort not only enhances the driving experience but also influences purchasing decisions, thereby propelling growth in the climate control-system-commercial-vehicle market.

Shift Towards Electrification

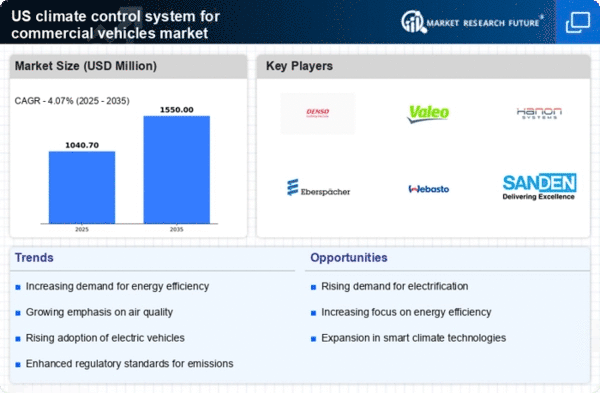

The ongoing shift towards electrification in the transportation sector is a significant driver for the climate control-system-commercial-vehicle market. As more manufacturers introduce electric commercial vehicles, the demand for specialized climate control systems that cater to electric powertrains is increasing. These systems must be designed to operate efficiently with limited energy resources, necessitating innovations in thermal management and energy recovery. The growing emphasis on sustainability and reducing carbon footprints further accelerates this trend. According to industry forecasts, the market for electric commercial vehicles is expected to grow at a CAGR of over 20% in the coming years, indicating a robust opportunity for climate control-system advancements tailored to this segment.

Regulatory Compliance Pressure

The climate control-system-commercial-vehicle market is influenced by stringent regulatory frameworks aimed at reducing emissions and enhancing energy efficiency. In the US, regulations from the Environmental Protection Agency (EPA) mandate lower greenhouse gas emissions from commercial vehicles. This regulatory pressure compels manufacturers to innovate and integrate advanced climate control systems that comply with these standards. As a result, the market is witnessing a shift towards more efficient systems that not only meet compliance but also improve overall vehicle performance. The potential for penalties and fines for non-compliance further drives investment in these technologies, making regulatory compliance a critical driver in the climate control-system-commercial-vehicle market.

Technological Advancements in HVAC Systems

Innovations in heating, ventilation, and air conditioning (HVAC) systems are transforming the climate control-system-commercial-vehicle market. The integration of smart technologies, such as IoT connectivity and predictive maintenance, is enhancing the efficiency and reliability of climate control systems. These advancements allow for real-time monitoring and adjustments, optimizing energy use and improving overall system performance. Furthermore, the development of lightweight materials and energy-efficient components is contributing to the reduction of overall vehicle weight, which can enhance fuel efficiency. As these technologies continue to evolve, they are likely to play a pivotal role in shaping the future of the climate control-system-commercial-vehicle market.