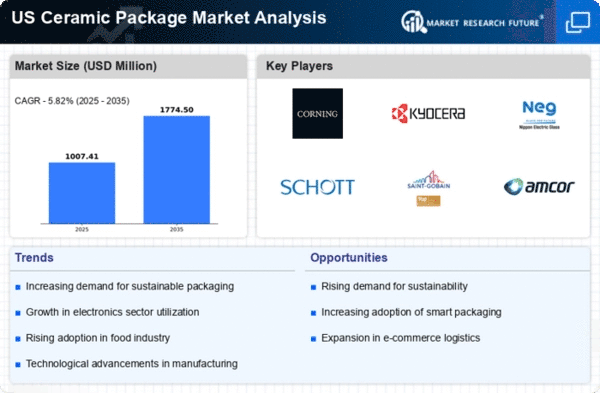

Growth in the Electronics Sector

The expansion of the electronics sector is a critical driver for the ceramic package market. With the increasing integration of advanced technologies in consumer electronics, the demand for reliable and durable packaging solutions is on the rise. Ceramic packages are favored for their excellent thermal stability and electrical insulation properties, making them ideal for semiconductor applications. In 2025, the electronics industry is expected to generate revenues exceeding $1 trillion, with a substantial portion allocated to packaging solutions. Consequently, the ceramic package market stands to gain from this growth, as manufacturers seek high-performance packaging options to enhance product reliability.

Advancements in Manufacturing Techniques

Innovations in manufacturing techniques are significantly influencing the ceramic package market. The introduction of advanced processes such as 3D printing and precision molding has enhanced the efficiency and quality of ceramic packaging production. These advancements allow for greater customization and reduced production costs, making ceramic packages more accessible to a wider range of industries. As the market evolves, manufacturers are likely to invest in these technologies to improve their competitive edge. The ceramic package market is thus poised for growth, as enhanced manufacturing capabilities enable the production of more sophisticated and tailored packaging solutions.

Rising Demand for Eco-Friendly Packaging

The ceramic package market is experiencing a notable increase in demand for eco-friendly packaging solutions. As consumers become more environmentally conscious, manufacturers are compelled to adopt sustainable practices. This shift is reflected in the growing preference for ceramic materials, which are recyclable and have a lower environmental impact compared to traditional packaging. In 2025, the market for eco-friendly packaging is projected to reach approximately $300 billion, with ceramic packaging accounting for a significant share. The ceramic package market is thus likely to benefit from this trend, as companies strive to meet consumer expectations and regulatory requirements regarding sustainability.

Increasing Applications in Medical Devices

The ceramic package market is witnessing a surge in applications within the medical device sector. As the healthcare industry continues to innovate, the need for reliable and sterile packaging solutions becomes paramount. Ceramic materials are recognized for their biocompatibility and resistance to chemical degradation, making them suitable for packaging sensitive medical devices. The medical device market is projected to reach $600 billion by 2025, with a growing emphasis on high-quality packaging. This trend presents a significant opportunity for the ceramic package market, as manufacturers align their offerings with the stringent requirements of the healthcare sector.

Regulatory Compliance and Safety Standards

The ceramic package market is increasingly influenced by stringent regulatory compliance and safety standards. As industries face heightened scrutiny regarding packaging materials, manufacturers are compelled to adhere to regulations that ensure product safety and environmental protection. The ceramic package market is likely to benefit from this trend, as ceramic materials often meet or exceed these regulatory requirements. In 2025, it is anticipated that compliance-related investments will account for a substantial portion of packaging budgets, driving demand for ceramic solutions that align with safety and sustainability standards.