Advancements in Drug Development

Innovations in drug development are significantly influencing the cardiomyopathy medication market. The emergence of novel therapeutic agents, including gene therapies and targeted treatments, is reshaping the landscape of cardiomyopathy management. For instance, recent advancements have led to the approval of medications that specifically target genetic mutations associated with certain types of cardiomyopathy. This progress not only enhances treatment efficacy but also attracts investment from pharmaceutical companies, which may lead to a broader range of available therapies. As a result, the cardiomyopathy medication market is likely to witness substantial growth driven by these advancements in drug development.

Increased Awareness and Education

Heightened awareness and education regarding cardiomyopathy are crucial drivers for the cardiomyopathy medication market. Initiatives by healthcare organizations and advocacy groups aim to inform both patients and healthcare professionals about the symptoms and risks associated with cardiomyopathy. This increased awareness leads to earlier diagnosis and treatment, which is essential for improving patient outcomes. Furthermore, educational campaigns may encourage patients to seek medical advice sooner, thereby increasing the demand for cardiomyopathy medications. As awareness continues to grow, the cardiomyopathy medication market is expected to expand, reflecting the need for effective treatment options.

Rising Prevalence of Cardiomyopathy

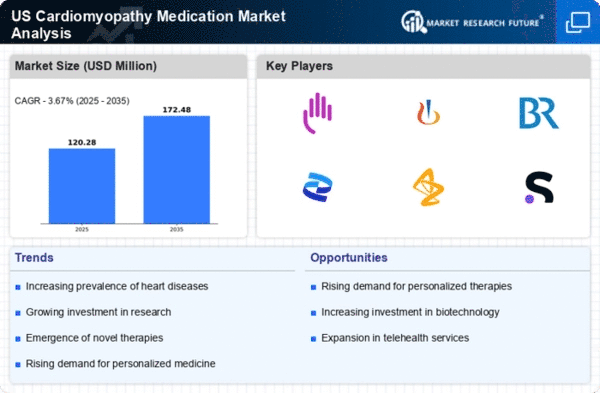

The increasing incidence of cardiomyopathy in the US is a primary driver for the cardiomyopathy medication market. Recent estimates suggest that approximately 1 in 500 individuals are affected by this condition, leading to a growing demand for effective treatment options. As awareness of cardiomyopathy rises, healthcare providers are more likely to diagnose and treat patients, further propelling the market. The aging population, which is more susceptible to heart diseases, contributes to this trend. Consequently, the cardiomyopathy medication market is expected to expand as pharmaceutical companies develop new therapies to address this rising prevalence, potentially increasing market revenues significantly.

Regulatory Support for New Therapies

Regulatory bodies in the US are increasingly supportive of the development and approval of new therapies for cardiomyopathy. Initiatives aimed at expediting the review process for innovative treatments are likely to enhance the cardiomyopathy medication market. For example, the FDA has implemented programs that facilitate faster access to promising therapies, which can significantly impact patient care. This regulatory support encourages pharmaceutical companies to invest in research and development, potentially leading to a wider array of treatment options for patients. As a result, the cardiomyopathy medication market may experience accelerated growth due to this favorable regulatory environment.

Growing Investment in Healthcare Infrastructure

The expansion of healthcare infrastructure in the US is a vital driver for the cardiomyopathy medication market. Increased funding for hospitals, clinics, and specialized cardiac care centers enhances the capacity to diagnose and treat cardiomyopathy effectively. This growth in infrastructure is accompanied by improved access to advanced diagnostic tools and treatment options, which can lead to better patient outcomes. As healthcare facilities become more equipped to handle cardiomyopathy cases, the demand for medications is likely to rise. Consequently, the cardiomyopathy medication market may benefit from this investment in healthcare infrastructure, reflecting a commitment to improving cardiac care.