Expansion of Industrial Automation

The capacitor banks market is significantly influenced by the expansion of industrial automation across various sectors. As industries adopt advanced automation technologies, the need for reliable and efficient power supply systems becomes paramount. Capacitor banks play a crucial role in stabilizing voltage levels and improving power factor, which is essential for the smooth operation of automated processes. The US manufacturing sector, for instance, has seen a substantial increase in automation investments, with projections indicating a growth rate of around 10% annually. This trend is likely to drive demand for capacitor banks, as they are integral to maintaining the performance and efficiency of automated systems. The capacitor banks market is thus poised to capitalize on this automation wave, ensuring that power supply systems can meet the demands of modern industrial operations.

Increasing Power Quality Requirements

The capacitor banks market is experiencing growth due to the rising demand for improved power quality in electrical systems. Industries are increasingly focusing on minimizing voltage fluctuations and harmonics, which can lead to equipment failure and operational inefficiencies. As a result, capacitor banks are being deployed to enhance power factor correction and voltage stability. According to recent data, the market for capacitor banks in the US is projected to reach approximately $1.5 billion by 2026, driven by these quality requirements. This trend indicates a shift towards more reliable and efficient power systems, which is essential for maintaining competitiveness in various sectors. The capacitor banks market is thus positioned to benefit from these evolving standards and regulations aimed at ensuring optimal power quality.

Technological Innovations in Power Electronics

The capacitor banks market is being propelled by technological innovations in power electronics, which are enhancing the performance and efficiency of capacitor bank systems. Advances in semiconductor technology and control systems are enabling more precise management of power quality and energy storage. These innovations are particularly relevant in applications requiring high reliability and efficiency, such as data centers and industrial facilities. The capacitor banks market is witnessing a shift towards smart capacitor banks that can automatically adjust to changing load conditions, thereby optimizing energy consumption. This trend is expected to drive market growth, with forecasts indicating a potential increase in market size by 15% over the next few years. As technology continues to evolve, the capacitor banks market is likely to benefit from these advancements, positioning itself as a critical component in modern power systems.

Regulatory Support for Energy Storage Solutions

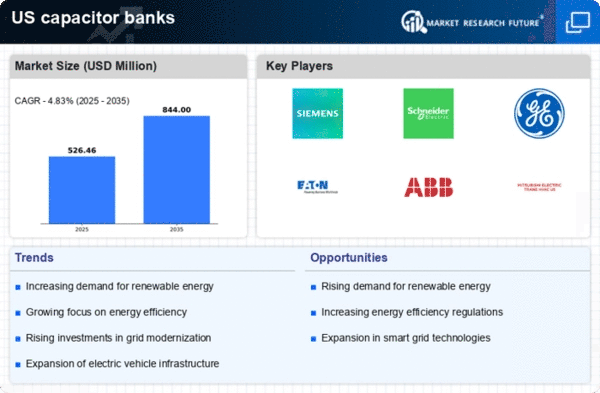

The capacitor banks market is benefiting from increasing regulatory support for energy storage solutions in the US. Government initiatives aimed at promoting energy efficiency and sustainability are encouraging the adoption of capacitor banks as a viable solution for energy storage and management. Policies that incentivize the use of capacitor banks for grid stability and peak load management are becoming more prevalent. For instance, the US Department of Energy has outlined various programs that support the integration of energy storage technologies, which includes capacitor banks. This regulatory environment is expected to enhance the growth of the capacitor banks market, with estimates suggesting a compound annual growth rate (CAGR) of 8% over the next five years. The capacitor banks market is thus likely to thrive under these supportive frameworks, facilitating the transition towards more sustainable energy practices.

Rising Investment in Renewable Energy Infrastructure

The capacitor banks market is poised for growth due to the rising investment in renewable energy infrastructure in the US. As the country transitions towards cleaner energy sources, the integration of renewable technologies such as wind and solar power necessitates the use of capacitor banks for effective energy management. These systems help in stabilizing the grid and ensuring a reliable power supply, which is critical for the successful deployment of renewable energy projects. Recent reports indicate that investments in renewable energy infrastructure are expected to exceed $100 billion by 2027, further driving the demand for capacitor banks. The capacitor banks market is thus likely to see increased activity as stakeholders seek to enhance grid reliability and efficiency in the face of growing renewable energy adoption.