Rising Demand for Minimally Invasive Treatments

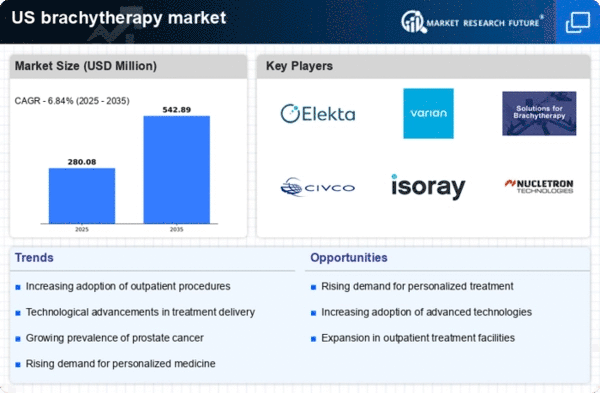

The brachytherapy market is experiencing a notable increase in demand for minimally invasive treatment options. Patients and healthcare providers are increasingly favoring procedures that reduce recovery time and minimize surgical risks. Brachytherapy, which involves placing radioactive sources directly at the tumor site, aligns with this trend by offering targeted treatment with fewer side effects compared to traditional therapies. According to recent data, the market is projected to grow at a CAGR of approximately 7.5% over the next few years, driven by this shift towards less invasive options. As awareness of the benefits of brachytherapy continues to rise, the market is likely to expand, attracting more investment and innovation in treatment methodologies.

Technological Innovations in Brachytherapy Devices

Technological innovations in brachytherapy devices are significantly impacting the brachytherapy market. Advances in imaging techniques and delivery systems are enhancing the precision of brachytherapy treatments. For instance, the integration of real-time imaging allows for better placement of radioactive sources, improving treatment efficacy. The market is witnessing the introduction of new devices that are more user-friendly and efficient, which could potentially increase adoption rates among healthcare providers. As these innovations continue to emerge, they are likely to attract more practitioners to the field, further driving the growth of the brachytherapy market.

Growing Investment in Cancer Treatment Technologies

Investment in cancer treatment technologies is a significant driver for the brachytherapy market. As healthcare systems in the US allocate more resources towards advanced cancer therapies, brachytherapy is gaining attention due to its effectiveness in treating localized cancers. The market has seen an influx of funding, with estimates suggesting that the sector could reach a valuation of $500 million by 2027. This financial support is crucial for research and development, leading to improved treatment options and enhanced patient outcomes. Furthermore, collaborations between medical institutions and technology firms are likely to foster innovation, thereby propelling the growth of the brachytherapy market.

Increased Awareness and Education on Cancer Treatments

Increased awareness and education regarding cancer treatments are pivotal in driving the brachytherapy market. Educational initiatives aimed at both healthcare professionals and patients are enhancing understanding of brachytherapy's benefits, including its precision and reduced side effects. As more patients become informed about their treatment options, the demand for brachytherapy is expected to rise. Recent surveys indicate that nearly 60% of patients prefer treatments that offer a better quality of life post-therapy. This shift in patient preference is likely to influence healthcare providers to adopt brachytherapy more widely, thereby expanding its market presence.

Supportive Reimbursement Policies for Cancer Treatments

Supportive reimbursement policies are a crucial driver for the brachytherapy market. As insurance companies and government programs recognize the effectiveness of brachytherapy in treating various cancers, they are increasingly covering these procedures. This trend is likely to enhance patient access to brachytherapy, as financial barriers are reduced. Recent policy changes have shown that reimbursement rates for brachytherapy procedures have improved, making them more appealing to both patients and healthcare providers. As reimbursement frameworks continue to evolve favorably, the brachytherapy market is expected to benefit from increased utilization and acceptance in clinical practice.