Expansion of Urban Waterway Access

The expansion of urban waterway access is significantly impacting the boat rental market. Many cities across the United States are investing in infrastructure improvements to enhance access to lakes, rivers, and coastal areas. This trend is particularly evident in metropolitan areas where urban dwellers are increasingly seeking recreational opportunities close to home. The availability of public docks and rental facilities is making it easier for residents to engage in boating activities without the need for ownership. According to the U.S. Army Corps of Engineers, urban waterway access has increased by over 25% in the past five years. This development is likely to drive growth in the boat rental market, as more individuals take advantage of the newly accessible waterways for leisure and exploration.

Growing Interest in Eco-Friendly Options

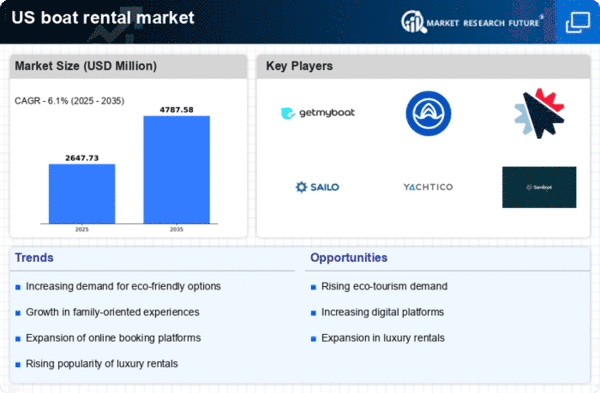

The boat rental market is witnessing a growing interest in eco-friendly options among consumers. As environmental awareness increases, many boaters are seeking sustainable alternatives that minimize their ecological footprint. This trend is reflected in the rising demand for electric and hybrid boats, which offer a quieter and cleaner boating experience. According to a recent survey, approximately 40% of boaters express a preference for rentals that utilize environmentally friendly technologies. Rental companies are responding by incorporating more eco-conscious vessels into their fleets, thereby appealing to environmentally aware customers. This shift not only enhances the reputation of the boat rental market but also aligns with broader sustainability initiatives across various sectors. As the demand for green boating options continues to rise, the industry may see a significant transformation in its offerings.

Increased Recreational Boating Participation

The boat rental market is experiencing a surge in recreational boating participation across the United States. According to the National Marine Manufacturers Association, approximately 87 million Americans engage in boating activities annually. This growing interest in water-based leisure activities is driving demand for boat rentals, as individuals seek affordable and flexible options to enjoy the waterways. The boat rental market benefits from this trend, as more people opt for rentals instead of ownership, which can be costly and burdensome. Additionally, the rise of social media and influencer culture has further popularized boating as a desirable pastime, encouraging new demographics to explore boating experiences. As a result, the boat rental market is likely to see continued growth, with rental companies expanding their fleets to accommodate the increasing number of participants.

Rising Disposable Income and Leisure Spending

Rising disposable income levels in the United States are contributing to the growth of the boat rental market. As consumers experience increased financial flexibility, they are more inclined to spend on leisure activities, including boating. Data from the Bureau of Economic Analysis indicates that personal consumption expenditures on recreational services have risen by approximately 5% annually. This trend suggests that more individuals are willing to allocate a portion of their budgets to experiences such as boat rentals. Additionally, the boat rental market is likely to benefit from the growing trend of experiential spending, where consumers prioritize unique experiences over material possessions. As disposable income continues to rise, the demand for boat rentals is expected to increase, further propelling the industry's growth.

Technological Advancements in Booking Systems

Technological advancements are reshaping the boat rental market, particularly in the realm of booking systems. The integration of mobile applications and online platforms has streamlined the rental process, making it more accessible for consumers. Data from the American Boating Association indicates that over 60% of boaters prefer to book rentals through digital platforms. This shift towards technology not only enhances user experience but also allows rental companies to manage their fleets more efficiently. Furthermore, the implementation of GPS tracking and real-time availability updates provides customers with greater transparency and convenience. As technology continues to evolve, the boat rental market is likely to see increased competition among providers, pushing them to innovate and improve their services to attract tech-savvy consumers.