Growing Adoption of Smart Contracts

The blockchain interoperability market is experiencing a growing adoption of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This trend is particularly relevant as businesses seek to automate processes and reduce reliance on intermediaries. The integration of smart contracts across various blockchain platforms necessitates robust interoperability solutions to ensure seamless execution. As of 2025, it is estimated that the use of smart contracts could increase transaction efficiency by up to 50%, thereby driving demand for interoperability solutions. This growing reliance on smart contracts is likely to play a pivotal role in shaping the future of the blockchain interoperability market.

Emergence of Hybrid Blockchain Models

The blockchain interoperability market is witnessing the emergence of hybrid blockchain models that combine the benefits of both public and private blockchains. These models allow organizations to maintain control over sensitive data while still benefiting from the transparency and security of public networks. As businesses seek to optimize their operations, hybrid solutions are becoming increasingly attractive. This shift is likely to drive investment in interoperability solutions that facilitate communication between different blockchain types. Analysts suggest that the adoption of hybrid models could account for over 40% of the blockchain interoperability market by 2027, as organizations strive to balance privacy and transparency in their operations.

Demand for Enhanced Security Protocols

The blockchain interoperability market is witnessing a heightened demand for enhanced security protocols as organizations become increasingly aware of the vulnerabilities associated with blockchain technology. As interoperability solutions facilitate communication between different networks, the potential for security breaches also rises. Consequently, businesses are prioritizing the implementation of advanced security measures to protect sensitive data and transactions. Recent studies indicate that nearly 70% of organizations consider security a top priority when selecting interoperability solutions. This focus on security is expected to drive innovation within the blockchain interoperability market, as companies seek to develop solutions that not only enhance connectivity but also ensure robust protection against cyber threats.

Rising Need for Seamless Data Exchange

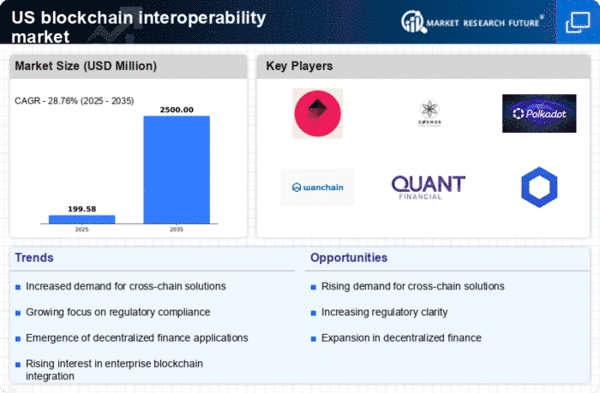

this market is experiencing a surge in demand for seamless data exchange across various blockchain networks. Organizations are increasingly recognizing the necessity of integrating disparate systems to enhance operational efficiency. This trend is particularly evident in sectors such as finance and supply chain management, where the ability to share data securely and efficiently can lead to significant cost savings. According to recent estimates, the market for blockchain interoperability solutions is projected to reach $5 billion by 2026, reflecting a compound annual growth rate (CAGR) of approximately 25%. This growth is driven by the need for businesses to leverage multiple blockchain platforms while ensuring compatibility and security, thereby fostering innovation and collaboration within the blockchain interoperability market.

Increased Investment in Blockchain Startups

The blockchain interoperability market is benefiting from a notable increase in investment directed towards blockchain startups focused on interoperability solutions. Venture capital firms and institutional investors are recognizing the potential of these startups to address critical challenges in the blockchain ecosystem. In 2025 alone, investments in blockchain technology reached approximately $30 billion, with a significant portion allocated to interoperability-focused ventures. This influx of capital is expected to accelerate innovation and the development of new solutions that enhance connectivity between different blockchain networks. As a result, the blockchain interoperability market is likely to expand rapidly, driven by the influx of fresh ideas and technologies.