Health and Wellness Trends

The beverage packaging market is significantly influenced by the rising health and wellness trends among consumers. As individuals become more health-conscious, there is a growing demand for packaging that reflects these values, such as portion control and clear labeling of nutritional information. In 2025, it is anticipated that beverages marketed as healthy will represent over 40% of the total beverage sales, prompting manufacturers to adapt their packaging accordingly. This shift not only caters to consumer preferences but also aligns with regulatory requirements for transparency in labeling. Consequently, the beverage packaging market is likely to evolve to accommodate these health-oriented demands, ensuring that packaging communicates the benefits of the products effectively.

Consumer Preference for Customization

The beverage packaging market is increasingly influenced by consumer preferences for customization and personalization. As consumers seek unique and tailored experiences, brands are responding by offering customizable packaging options that allow for individual expression. This trend is particularly evident in the craft beverage sector, where small producers leverage unique packaging designs to differentiate their products. In 2025, it is estimated that customized packaging will account for approximately 20% of the beverage packaging market. This shift not only enhances consumer engagement but also fosters brand loyalty, as personalized packaging resonates more deeply with consumers. As the demand for customization grows, the beverage packaging market is likely to adapt to these evolving consumer expectations.

Technological Advancements in Packaging

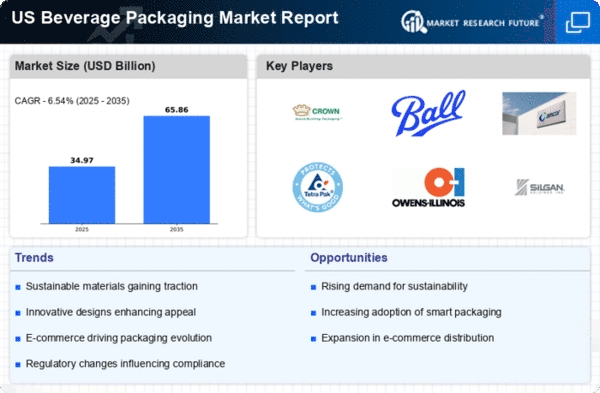

Technological innovations are reshaping the beverage packaging market, enabling manufacturers to enhance product safety, shelf life, and consumer engagement. Advanced technologies such as smart packaging, which includes QR codes and NFC tags, allow brands to provide consumers with real-time information about product freshness and origin. In 2025, the integration of technology in packaging is projected to increase by 15%, reflecting a growing trend towards interactive and informative packaging solutions. This evolution not only improves the consumer experience but also helps brands differentiate themselves in a competitive market. As technology continues to advance, the beverage packaging market is likely to see further innovations that cater to both consumer preferences and operational efficiencies.

Rising Demand for Eco-Friendly Materials

The beverage packaging market is experiencing a notable shift towards eco-friendly materials, driven by increasing consumer awareness regarding environmental sustainability. As more consumers prioritize products with minimal environmental impact, manufacturers are compelled to adopt biodegradable and recyclable materials. In 2025, it is estimated that the market for sustainable packaging solutions will account for approximately 30% of the total market. This trend is further supported by regulatory pressures aimed at reducing plastic waste, which could lead to a significant transformation in packaging strategies across the industry. Companies that invest in sustainable materials may not only enhance their brand image but also capture a growing segment of environmentally conscious consumers.

E-commerce Growth and Packaging Adaptation

The rapid growth of e-commerce is reshaping the beverage packaging market, as online sales of beverages continue to rise. This trend necessitates the development of packaging solutions that can withstand the rigors of shipping while ensuring product integrity. In 2025, it is projected that e-commerce will account for nearly 25% of beverage sales, compelling manufacturers to innovate in packaging design to enhance durability and reduce waste. Additionally, packaging must be designed for easy handling and disposal, aligning with consumer expectations for convenience. As e-commerce becomes a dominant sales channel, the beverage packaging market will likely see a surge in demand for packaging that meets these logistical challenges.